A trade finance loan agreement template is a standardized document that outlines the terms and conditions of a loan provided for international trade transactions. This template serves as a legal contract between the lender (often a bank or financial institution) and the borrower (typically a business or individual). A well-crafted template is essential for ensuring a smooth and successful trade finance transaction, protecting the interests of both parties, and mitigating risks.

Key Components of a Trade Finance Loan Agreement Template

A trade finance loan agreement template typically includes the following essential components:

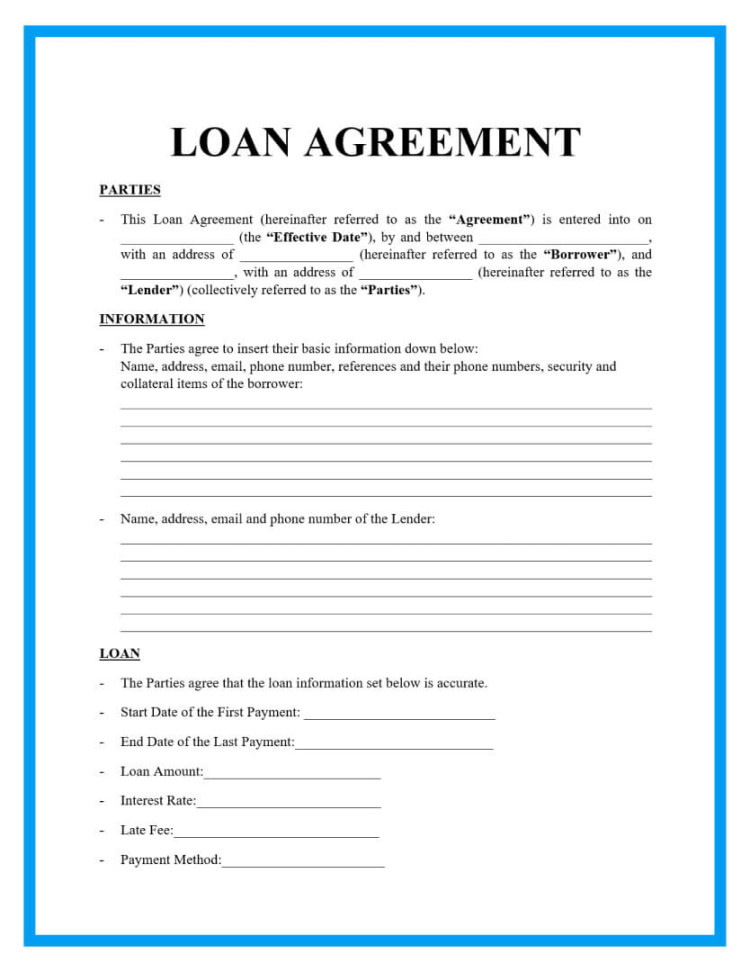

1. Parties Involved: Clearly identify the lender and borrower, including their legal names, addresses, and contact information.

2. Loan Amount and Terms: Specify the total amount of the loan, the interest rate, and the repayment schedule.

3. Collateral and Security: Outline any assets or guarantees that the borrower is providing as collateral to secure the loan.

4. Loan Purpose: Clearly state the specific purpose for which the loan is being granted.

5. Repayment Schedule: Detail the frequency and due dates of loan repayments, including any grace periods or deferral options.

6. Default Provisions: Define the events that constitute a default on the loan and outline the consequences of such a default.

7. Governing Law and Jurisdiction: Specify the applicable laws and the jurisdiction in which any disputes arising from the agreement will be resolved.

8. Representations and Warranties: Include statements made by the borrower regarding their financial condition, business operations, and compliance with applicable laws.

9. Events of Default: Define the circumstances under which the lender can declare the borrower in default, such as failure to make payments, breach of contract, or insolvency.

10. Remedies: Outline the remedies available to the lender in case of default, including acceleration of the loan, foreclosure on collateral, and legal action.

11. Dispute Resolution: Specify the mechanism for resolving disputes, such as mediation or arbitration.

12. Governing Law and Jurisdiction: Indicate the applicable laws and the jurisdiction where any legal proceedings related to the agreement will take place.

Designing a Professional Trade Finance Loan Agreement Template

To create a professional and effective trade finance loan agreement template, consider the following design elements:

1. Clarity and Conciseness: Use clear and concise language that is easy to understand. Avoid legal jargon and technical terms that may confuse the parties involved.

2. Consistent Formatting: Maintain consistent formatting throughout the document, using headings, subheadings, and bullet points to improve readability.

3. Professional Layout: Choose a professional font and font size that is easy to read. Use appropriate margins and line spacing to create a visually appealing document.

4. Legal Language: While aiming for clarity, ensure that the language used is legally sound and accurately reflects the intended terms and conditions.

5. Customization: Tailor the template to the specific needs of the transaction, including any unique terms or conditions that may be applicable.

6. Review and Approval: Have the template reviewed by legal counsel to ensure that it complies with all relevant laws and regulations. Obtain the signatures of both the lender and the borrower to make the agreement legally binding.

By carefully considering these design elements, you can create a professional trade finance loan agreement template that effectively protects the interests of both parties and facilitates a successful transaction.