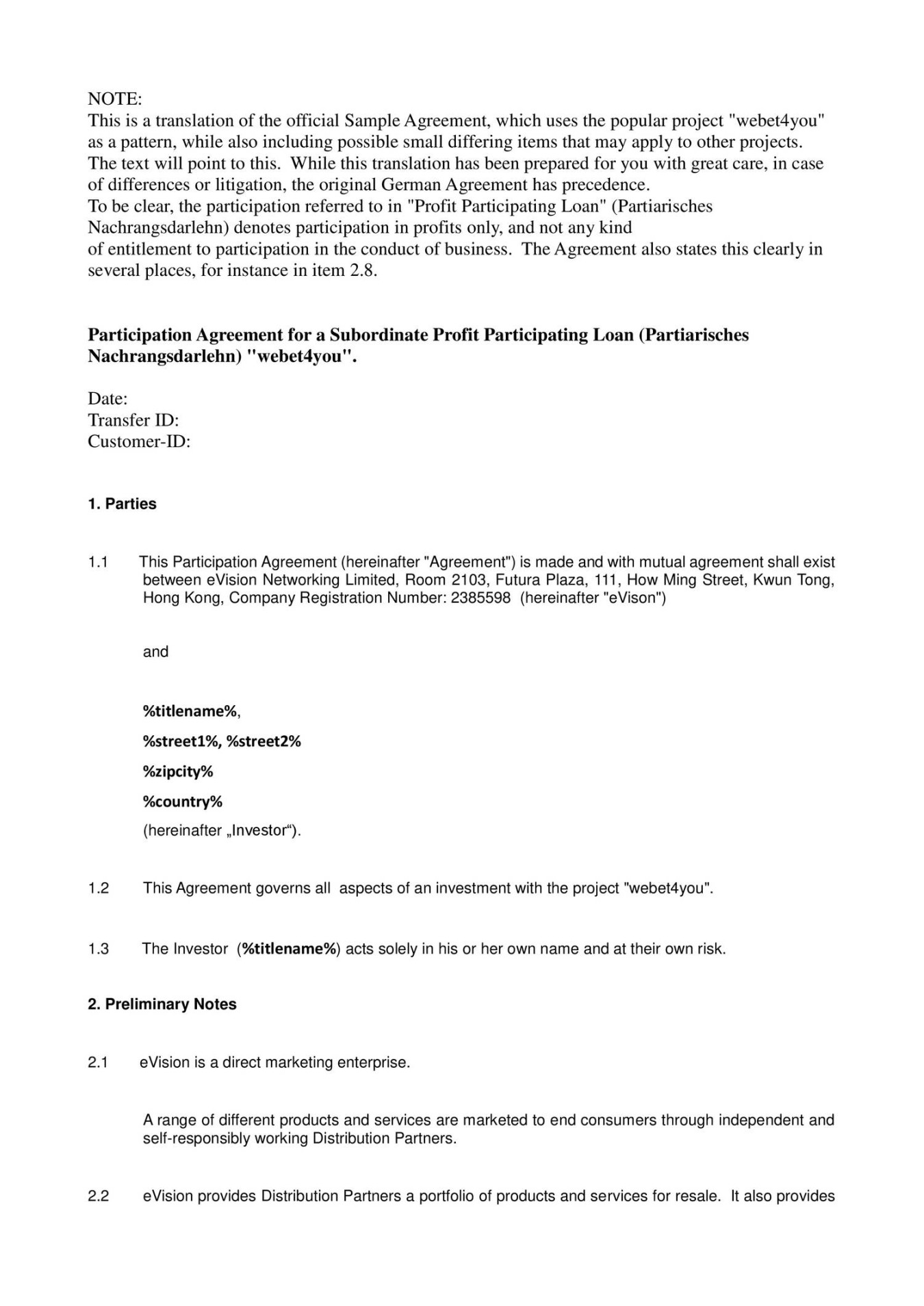

A profit participation loan agreement is a legal document that outlines the terms and conditions of a loan where the lender receives a share of the borrower’s profits in addition to interest payments. This type of loan is often used in business ventures where the lender is willing to take on more risk in exchange for a potential higher return.

Key Elements of a Profit Participation Loan Agreement

A well-structured profit participation loan agreement should include the following essential elements:

1. Parties Involved

Borrower: The entity receiving the loan.

2. Loan Amount and Terms

Principal Amount: The total amount of the loan.

3. Profit Participation

Profit Definition: A clear definition of what constitutes “profit” for the purposes of the agreement.

4. Security and Collateral

Collateral: Any assets the borrower pledges as security for the loan.

5. Default and Remedies

Default Events: Specific actions or circumstances that constitute a default.

6. Governing Law and Dispute Resolution

Governing Law: The jurisdiction that will govern the agreement.

7. Entire Agreement and Amendments

Entire Agreement: A statement that the agreement constitutes the entire understanding between the parties.

8. Notices

Addresses: The addresses of the borrower and lender for sending notices.

9. Execution

Design Elements for a Professional Template

To create a professional and trustworthy profit participation loan agreement template, consider the following design elements:

Clear and Concise Language: Use simple, straightforward language that is easy to understand.

Additional Considerations

Legal Counsel: Consult with an attorney to ensure the agreement complies with applicable laws and protects your interests.

By carefully considering these elements and seeking professional guidance, you can create a comprehensive and professional profit participation loan agreement template that effectively protects your interests and establishes a clear framework for the loan relationship.