A line of credit loan agreement template is a legal document that outlines the terms and conditions of a line of credit loan between a lender and a borrower. This template serves as a foundation for the agreement, ensuring that both parties understand their rights and obligations. When creating a professional line of credit loan agreement template, it is essential to prioritize clarity, comprehensiveness, and legal accuracy.

Essential Elements of a Line of Credit Loan Agreement Template

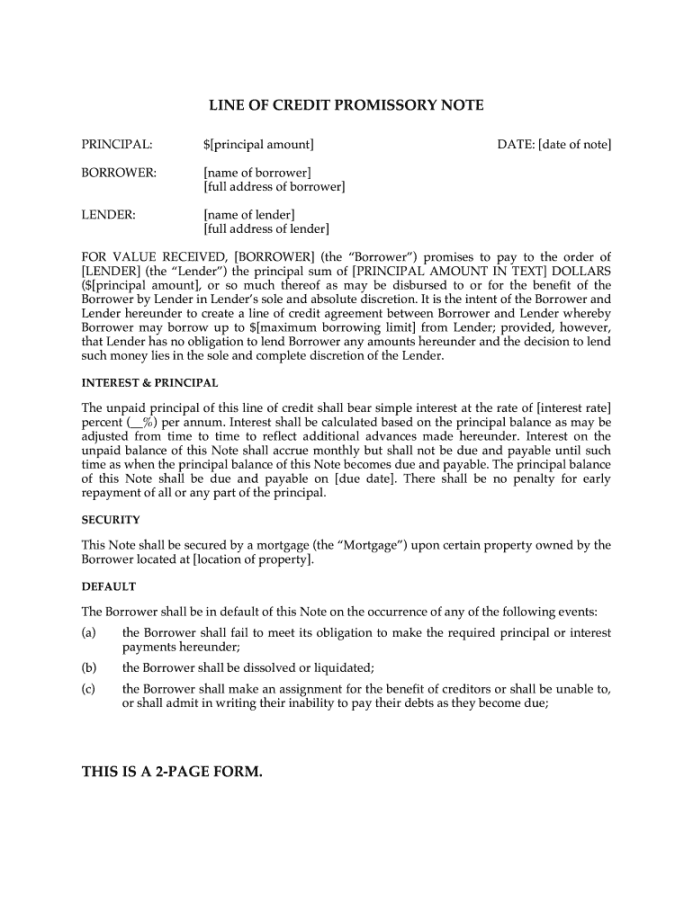

1. Parties Involved: Clearly identify the lender and borrower, including their legal names and addresses.

2. Credit Limit: Specify the maximum amount that the borrower can borrow under the line of credit.

3. Interest Rate: Indicate the interest rate that will be applied to the outstanding balance of the loan. This may be a fixed or variable rate.

4. Repayment Terms: Outline the repayment schedule, including the minimum monthly payment amount and any applicable grace periods.

5. Security: If applicable, describe any collateral or security that the borrower is providing to secure the loan.

6. Default: Define what constitutes a default under the agreement and specify the remedies available to the lender in case of default.

7. Prepayment: Address the borrower’s right to prepay the loan and any associated prepayment penalties.

8. Governing Law: Specify the jurisdiction that will govern the interpretation and enforcement of the agreement.

9. Notices: Outline the procedures for giving notices between the lender and borrower.

10. Entire Agreement: Include a clause stating that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous agreements.

Design Elements for Professionalism and Trust

To create a professional and trustworthy line of credit loan agreement template, consider the following design elements:

1. Layout and Formatting: Use a clean and consistent layout with clear headings, subheadings, and bullet points. Ensure that the text is easy to read and understand.

2. Font Choice: Select a professional and legible font that is easy on the eyes. Avoid using overly decorative or difficult-to-read fonts.

3. Color Scheme: Choose a color scheme that is professional and visually appealing. Avoid using excessive colors or bright, distracting hues.

4. Logo and Branding: Include the lender’s logo and branding elements to establish credibility and professionalism.

5. White Space: Use white space effectively to create a visually appealing and easy-to-read document. Avoid overcrowding the page with text.

6. Language: Use clear and concise language that is easy to understand. Avoid legal jargon that may confuse the borrower.

7. Organization: Present the information in a logical and organized manner, making it easy for the borrower to find the information they need.

Additional Considerations

When creating a line of credit loan agreement template, it is also important to consider the following:

Legal Compliance: Ensure that the template complies with all applicable laws and regulations, including consumer protection laws.

By carefully considering these elements, you can create a professional and trustworthy line of credit loan agreement template that effectively protects the interests of both the lender and the borrower.