An investment receipt template is a formal document that serves as a record of a financial transaction involving an investment. It provides essential details about the investment, the investor, and the terms of the transaction. A well-designed investment receipt template can enhance the professionalism and credibility of your investment business.

Key Elements of an Investment Receipt Template

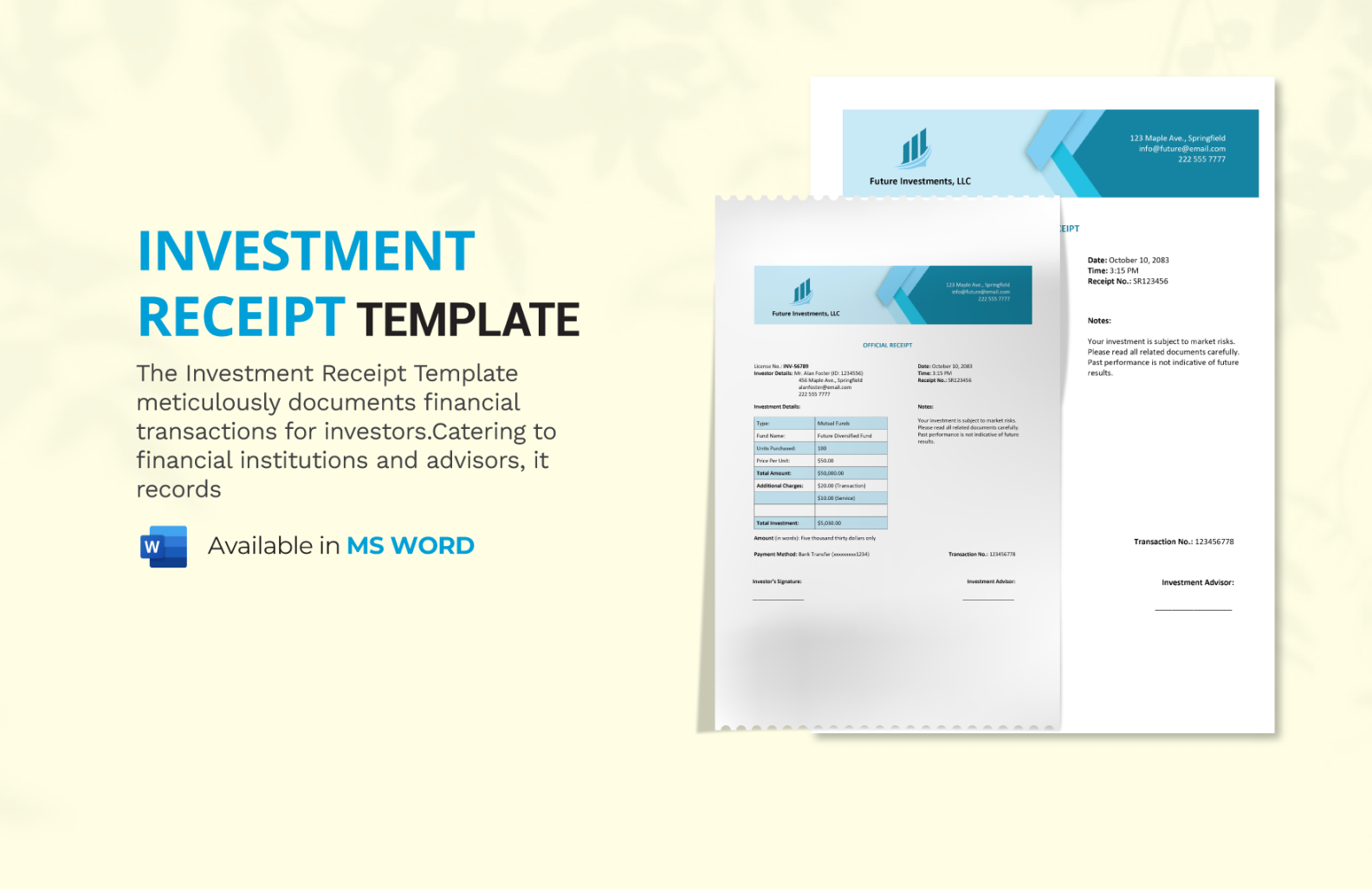

1. Header: The header should prominently display your company name, logo, and contact information. It should also include the date of the transaction.

2. Investment Details: This section should clearly specify the type of investment, the investment amount, the investment period, and the expected return.

3. Investor Information: Include the investor’s full name, address, contact information, and unique identifier (e.g., account number).

4. Payment Information: Detail the payment method (e.g., check, wire transfer), the payment amount, and the date of receipt.

5. Terms and Conditions: Outline the terms and conditions governing the investment, including any fees, penalties, or restrictions.

6. Authorization: Provide a space for the investor to sign and date the receipt, acknowledging receipt of the document and agreement to the terms and conditions.

7. Footer: The footer should include a reference number or transaction ID for tracking purposes.

Design Considerations for a Professional Investment Receipt Template

1. Layout and Formatting:

2. Color Scheme:

3. Typography:

4. White Space:

5. Branding:

Example Investment Receipt Template

Your Company Name

[Logo]

[Contact Information]

Date: [Date]

Investment Details:

Investor Information:

Payment Information:

Terms and Conditions:

Authorization:

Investor Signature: __________________________________

Date: __________________________________

Footer:

Reference Number: [Reference Number]

Additional Tips

Consider using a template software or online tool to create your investment receipt template. This can save you time and effort.