An in-kind donation receipt is a formal document acknowledging the receipt of goods or services donated to an organization. It serves as a legal record for both the donor and the recipient, providing essential information about the donation. This guide will delve into the essential elements and design considerations for crafting a professional in-kind donation receipt template using WordPress format.

Essential Elements

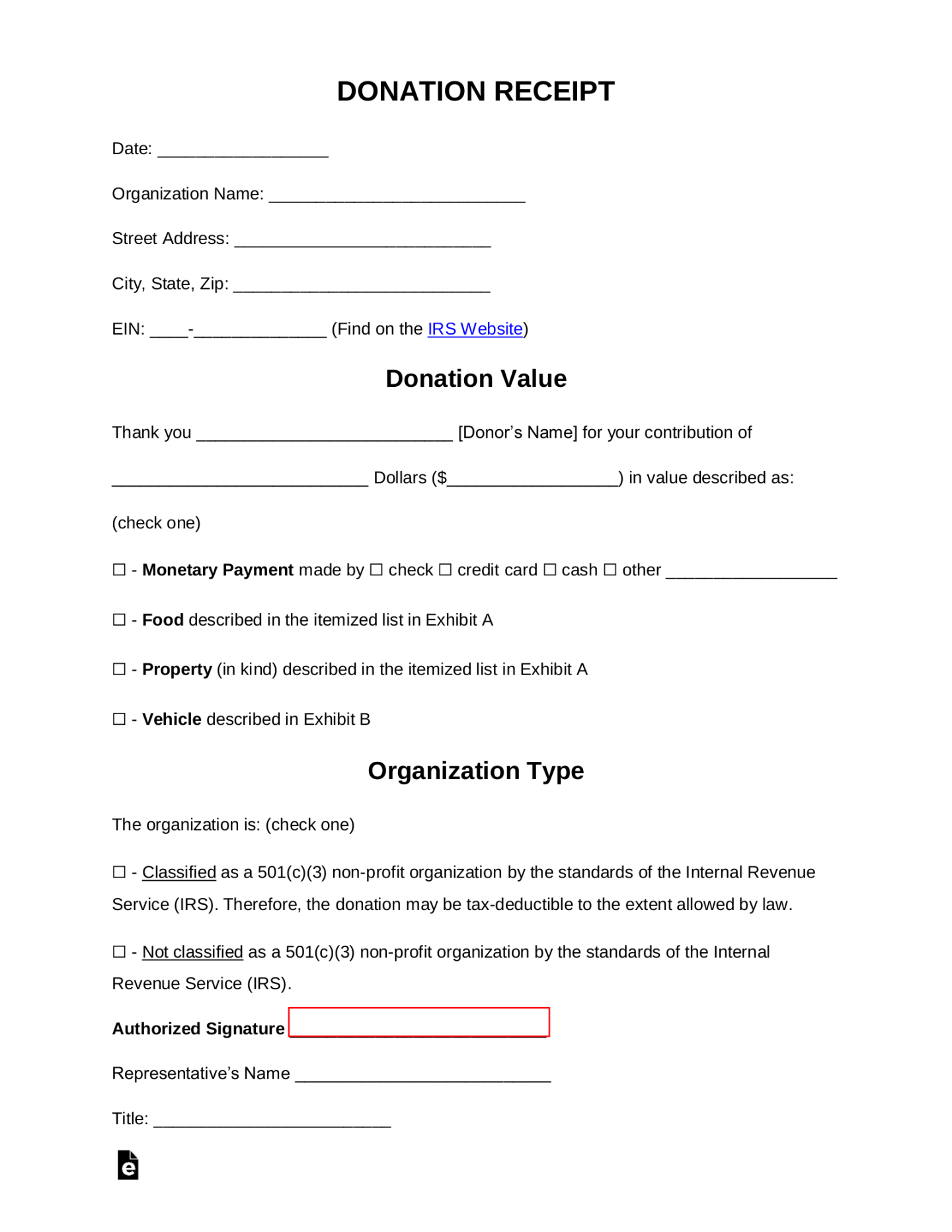

1. Donor Information: Clearly state the donor’s name, address, and contact information. This information is crucial for future correspondence and tax purposes.

2. Organization Information: Provide the organization’s full name, address, and contact details. Include the organization’s tax-exempt status and identification number.

3. Donation Description: Specify the exact nature of the donated items or services. Be as detailed as possible, including quantities, brands, or models.

4. Donation Date: Indicate the date the donation was received.

5. Fair Market Value: Estimate the fair market value of the donated items or services. This value is essential for tax purposes and should be based on recent appraisals or market research.

6. Receipt Number: Assign a unique receipt number to each donation for tracking and reference purposes.

7. Signature: Include a designated space for the authorized representative of the organization to sign the receipt. This signature confirms the receipt of the donation.

Design Considerations

1. Layout and Formatting: Choose a clean and professional layout that is easy to read and understand. Use a consistent font and font size throughout the template. Ensure that the information is well-organized and easy to locate.

2. Branding: Incorporate the organization’s branding elements into the template, such as the logo, colors, and fonts. This helps to maintain a consistent visual identity and reinforces the organization’s professionalism.

3. Clarity and Conciseness: Use clear and concise language throughout the template. Avoid jargon or technical terms that may be unfamiliar to the donor. Keep the information focused and to the point.

4. Professional Appearance: Pay attention to the overall appearance of the template. Use high-quality paper and printing to create a professional and polished document.

5. Legal Compliance: Ensure that the template complies with all relevant legal requirements, including tax laws and Reporting regulations. Consult with legal counsel to ensure that the receipt is legally sound.

WordPress Implementation

To create an in-kind donation receipt template in WordPress, you can utilize the following methods:

1. Custom Theme Development: If you have experience with WordPress development, you can create a custom theme that includes a dedicated template for in-kind donation receipts. This approach offers the greatest flexibility and control over the design and functionality of the template.

2. Page Builder Plugins: Many WordPress page builder plugins, such as Elementor or Beaver Builder, allow you to create custom templates without writing code. These plugins provide a visual interface that makes it easy to design and customize the receipt template.

3. PDF Plugins: If you need to generate PDF versions of the receipts, you can use a PDF plugin like WP-PDF or PDFmyURL. These plugins allow you to create PDF documents based on your WordPress content, including the in-kind donation receipt template.

By carefully considering the essential elements and design considerations outlined in this guide, you can create a professional and effective in-kind donation receipt template that meets the needs of your organization and provides a valuable record for donors.