A financial confidentiality agreement (FCA) is a legal document that outlines the confidential information that will be shared between two or more parties involved in a financial transaction. This agreement ensures that sensitive financial data remains protected and prevents unauthorized disclosure.

Key Components of a Financial Confidentiality Agreement Template

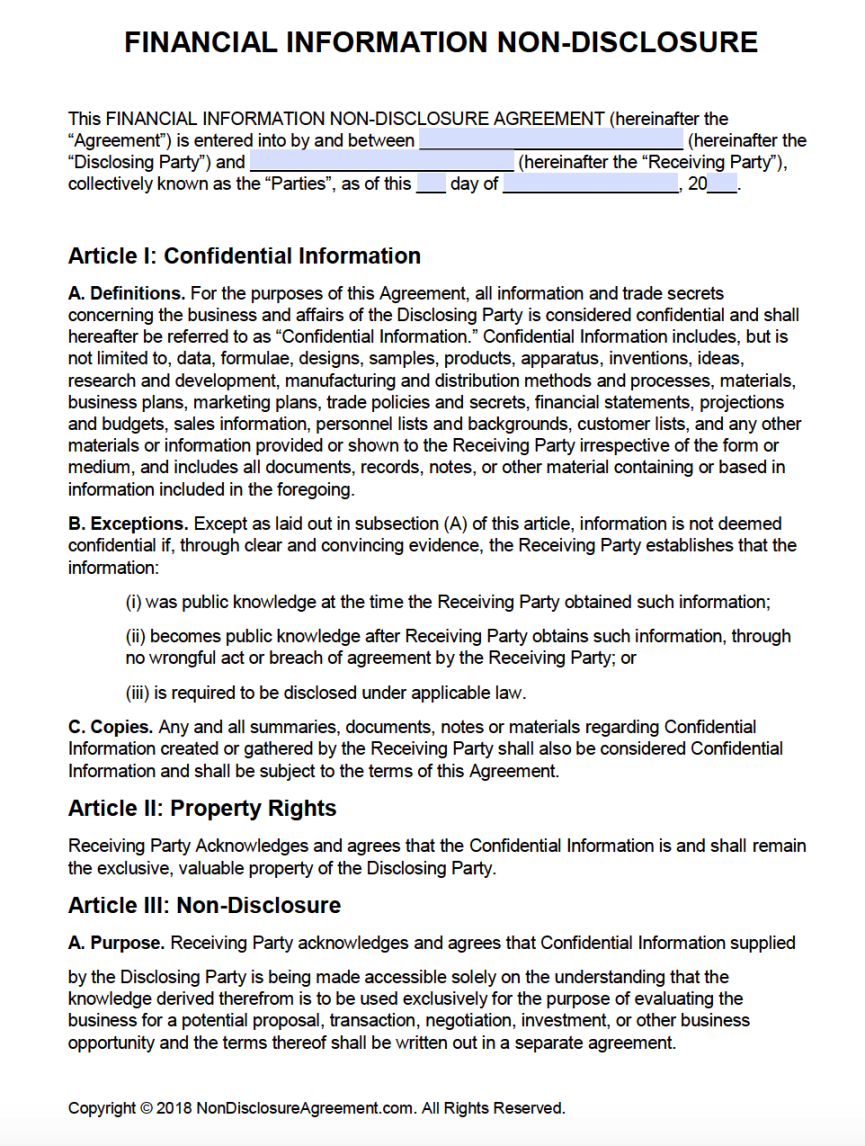

1. Parties: Clearly identify the parties involved in the agreement. This includes their full legal names and addresses.

2. Recitals: This section provides background information about the agreement, such as the purpose of the disclosure and the relationship between the parties.

3. Definitions: Define any technical terms or industry-specific jargon that may be used in the agreement. This ensures clarity and understanding.

4. Confidential Information: Explicitly define what constitutes confidential information. This may include financial statements, projections, business plans, customer data, and other sensitive information.

5. Obligations of Confidentiality: Outline the obligations of each party to maintain the confidentiality of the disclosed information. This includes restrictions on disclosure to third parties and the use of the information for unauthorized purposes.

6. Exceptions: Specify any exceptions to the confidentiality obligation. This may include disclosures required by law or court order, or for the protection of the disclosing party’s rights.

7. Return or Destruction: Address the return or destruction of confidential information upon termination of the agreement or at the request of the disclosing party.

8. Indemnification: Include provisions for indemnification, which require one party to compensate the other for any losses or damages arising from a breach of the agreement.

9. Governing Law and Jurisdiction: Specify the governing law and jurisdiction that will apply to any disputes arising from the agreement.

10. Entire Agreement: State that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

11. Severability: Include a severability clause that states that if any provision of the agreement is found to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

12. Notices: Specify the address and method for delivering notices between the parties.

13. Signatures: Ensure that the agreement is signed by authorized representatives of both parties.

Design Elements for a Professional Financial Confidentiality Agreement Template

Clear and Concise Language: Use clear and concise language that is easy to understand. Avoid legal jargon or technical terms that may confuse the parties.

By following these guidelines, you can create a professional financial confidentiality agreement template that effectively protects sensitive financial information and establishes a clear framework for the relationship between the parties.