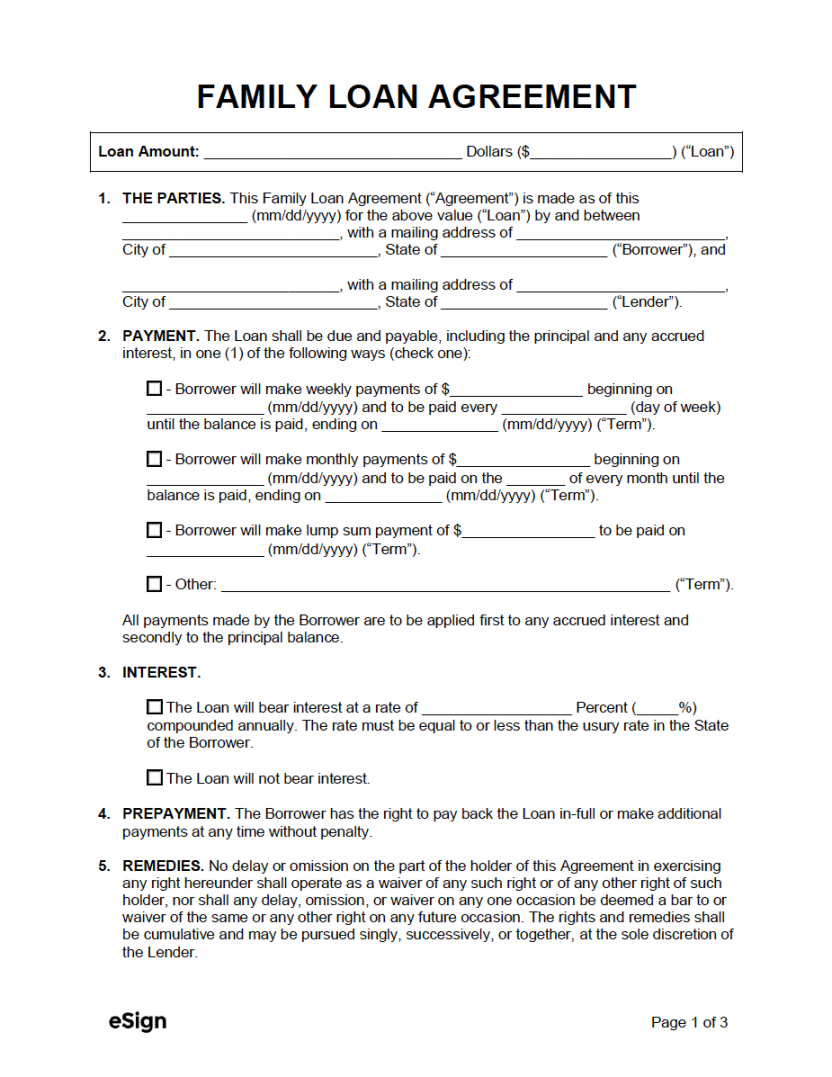

A family loan agreement template is a legal document that outlines the terms and conditions of a loan between family members. It provides clarity and protection for both the lender and the borrower, ensuring that the loan is repaid in full and on time. A well-crafted template can help avoid misunderstandings and disputes, fostering harmonious relationships within the family.

Essential Elements of a Family Loan Agreement Template

1. Loan Amount and Repayment Schedule: Clearly state the total loan amount, interest rate (if applicable), and the repayment schedule. Specify the frequency of payments (e.g., monthly, quarterly) and the due date for each payment.

2. Interest Rate: If applicable, specify the interest rate and whether it is fixed or variable. If the interest rate is variable, outline how it will be adjusted.

3. Late Payment Penalties: Clearly define the consequences of late payments, such as late fees or interest accrual.

4. Prepayment Clause: If applicable, include a prepayment clause that outlines the terms under which the borrower can repay the loan early.

5. Security (Collateral): If the loan is secured by collateral, describe the specific assets that will be used as collateral.

6. Default Clause: Specify the events that would constitute a default, such as failure to make payments on time or breach of other terms.

7. Dispute Resolution: Outline the procedure for resolving disputes that may arise between the lender and the borrower.

8. Governing Law: Indicate the jurisdiction that will govern the loan agreement.

9. Signatures: Ensure that both the lender and the borrower sign the agreement to make it legally binding.

Design Considerations for a Professional Family Loan Agreement Template

1. Layout and Formatting: Use a clean and professional layout that is easy to read and understand. Choose a font that is legible and consistent with the overall tone of the document.

2. Heading and Subheadings: Use clear and concise headings and subheadings to organize the content and make it easier to navigate.

3. White Space: Incorporate sufficient white space to improve readability and create a visually appealing document.

4. Numbering and Bullets: Use numbering and bullets to list items and create a structured format.

5. Legal Terminology: Use clear and simple language that is easy for non-lawyers to understand. Avoid legal jargon that may confuse the reader.

6. Professional Appearance: Choose a template design that conveys professionalism and trust. Avoid using overly casual or informal language.

Additional Tips for Creating a Professional Family Loan Agreement Template

Consult with an Attorney: If you are unsure about any of the terms or conditions of the loan agreement, it is advisable to consult with an attorney to ensure that the document is legally sound.

By following these guidelines, you can create a professional family loan agreement template that effectively protects the interests of both the lender and the borrower. A well-crafted template can help to maintain strong family relationships and avoid potential conflicts.