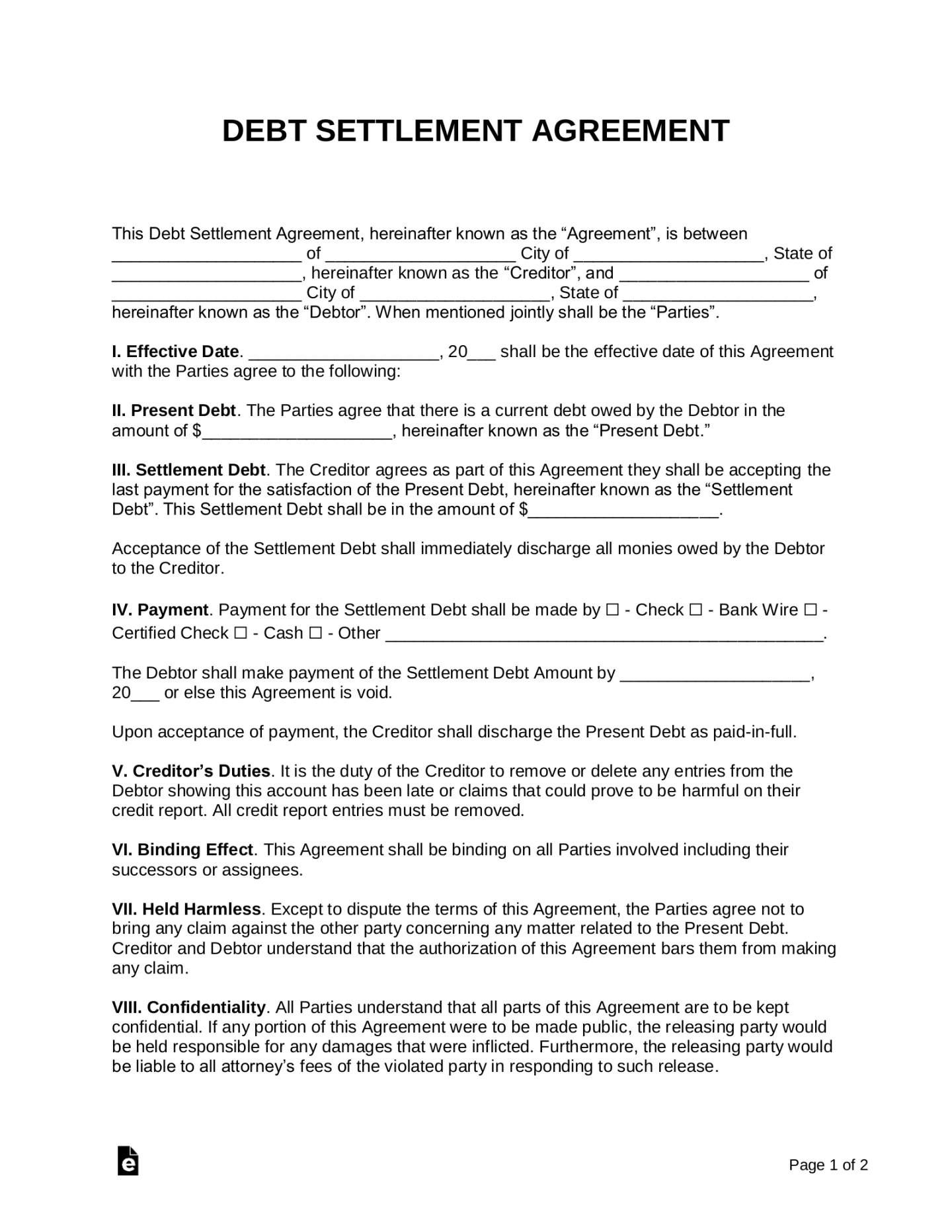

A debt settlement agreement letter is a formal document that outlines the terms and conditions of a negotiated agreement between a debtor and a creditor to settle a debt for less than the full amount owed. This agreement is typically reached when the debtor is unable to pay the full amount of the debt and the creditor agrees to accept a lesser amount in full settlement.

Key Components of a Debt Settlement Agreement Letter

1. Identification of Parties: Clearly state the names and addresses of both the debtor and the creditor.

2. Debt Amount: Specify the total amount of the debt, including any accrued interest and fees.

3. Settlement Amount: Indicate the agreed-upon settlement amount that the debtor will pay to the creditor.

4. Payment Terms: Outline the payment schedule, including the due date for the settlement amount.

5. Release of Liability: Stipulate that upon full payment of the settlement amount, the creditor will release the debtor from any further liability related to the debt.

6. Confidentiality: Consider including a confidentiality clause to protect the sensitive financial information of both parties.

7. Dispute Resolution: Specify the mechanism for resolving any disputes that may arise between the parties.

8. Governing Law: Indicate the jurisdiction that will govern the terms of the agreement.

9. Signatures: Ensure that both the debtor and the creditor sign the agreement to make it legally binding.

Design Elements for a Professional Debt Settlement Agreement Letter

1. Letterhead: Use a professional letterhead with your contact information and logo.

2. Date: Include the date the letter is written.

3. Salutation: Address the letter to the appropriate person at the creditor’s organization.

4. Body: Use clear and concise language, avoiding legal jargon that may be difficult for the debtor to understand.

5. Formatting: Use a consistent font and font size throughout the letter. Right-align the date and salutation, and left-align the body of the letter.

6. Margins: Maintain adequate margins to ensure readability.

7. Spacing: Use single-spaced lines for the body of the letter, with double-spaced lines between paragraphs.

8. Signature Line: Provide a space for the debtor to sign the agreement, along with their printed name.

9. Enclosures: If any supporting documents are attached to the letter, list them in the bottom left-hand corner.

Example Debt Settlement Agreement Letter

[Your Name]

[Your Address]

[City, State, ZIP]

[Date]

[Creditor’s Name]

[Creditor’s Address]

[City, State, ZIP]

Dear [Creditor’s Name],

This letter serves as a formal agreement between [Your Name] (the “Debtor”) and [Creditor’s Name] (the “Creditor”) to settle a debt in the amount of [Debt Amount].

The Debtor agrees to pay the Creditor the sum of [Settlement Amount] in full settlement of the aforementioned debt. Payment shall be made in a single lump sum on [Due Date].

Upon full payment of the settlement amount, the Creditor agrees to release the Debtor from any further liability related to the debt.

This agreement is subject to the laws of [Governing Jurisdiction]. Any disputes arising from this agreement shall be resolved through [Dispute Resolution Mechanism].

Please sign and return a copy of this letter to indicate your acceptance of the terms and conditions outlined herein.

Sincerely,

[Your Name]

[Your Signature]

Conclusion

A well-crafted debt settlement agreement letter is essential for establishing a clear and legally binding agreement between a debtor and a creditor. By following the guidelines outlined in this guide, you can create a professional and effective document that protects the interests of both parties.