Essential Sections

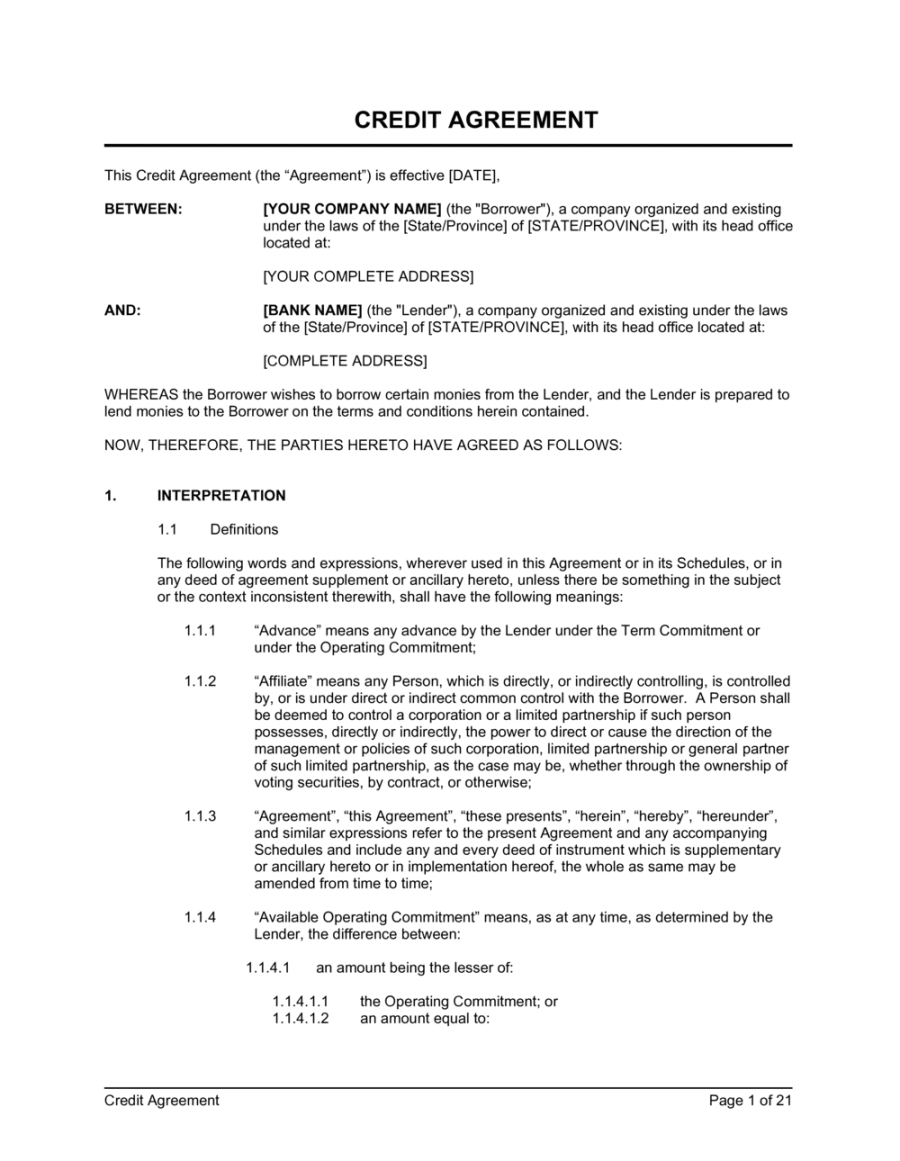

1. Parties

Clearly identify the parties involved in the agreement. This typically includes the name and address of the seller (you) and the buyer.

2. Definitions

Define key terms that may be unfamiliar to the buyer or that have specific meanings within the context of the agreement.

3. Credit Limit

Specify the maximum amount of credit that the buyer is allowed to extend at any given time.

4. Payment Terms

Outline the payment schedule and acceptable payment methods.

5. Interest on Overdue Amounts

Specify the interest rate that will be charged on overdue balances.

6. Security

If applicable, outline any security interests that the seller is taking in the buyer’s assets to secure the payment of the debt.

7. Default

Define what constitutes a default under the agreement.

8. Remedies for Default

Specify the remedies available to the seller in the event of a default.

9. Governing Law and Jurisdiction

Indicate the governing law that will apply to the agreement and the jurisdiction in which any disputes will be resolved.

10. Entire Agreement

State that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

11. Notices

Specify how notices will be given under the agreement, including the address to which notices should be sent.

12. Assignment and Waiver

Address the assignability of the agreement and the ability of the parties to waive their rights under the agreement.

13. Force Majeure

If applicable, include a force majeure clause that excuses the parties from performance in the event of unforeseen circumstances beyond their control.

Design Considerations

Clarity and Conciseness: Use clear and concise language that is easy to understand. Avoid legal jargon that may confuse the buyer.

By carefully considering these elements, you can create a credit terms agreement template that is both professional and effective.