A credit Card authorization form is a crucial document that outlines the terms and conditions of a transaction, ensuring both the customer and the merchant are protected. In Australia, where e-commerce and online transactions are becoming increasingly prevalent, having a well-designed and legally compliant credit card authorization form is essential. This guide will provide you with the necessary steps to create a professional credit card authorization form template that effectively conveys trust and professionalism.

Essential Elements of a Credit Card Authorization Form

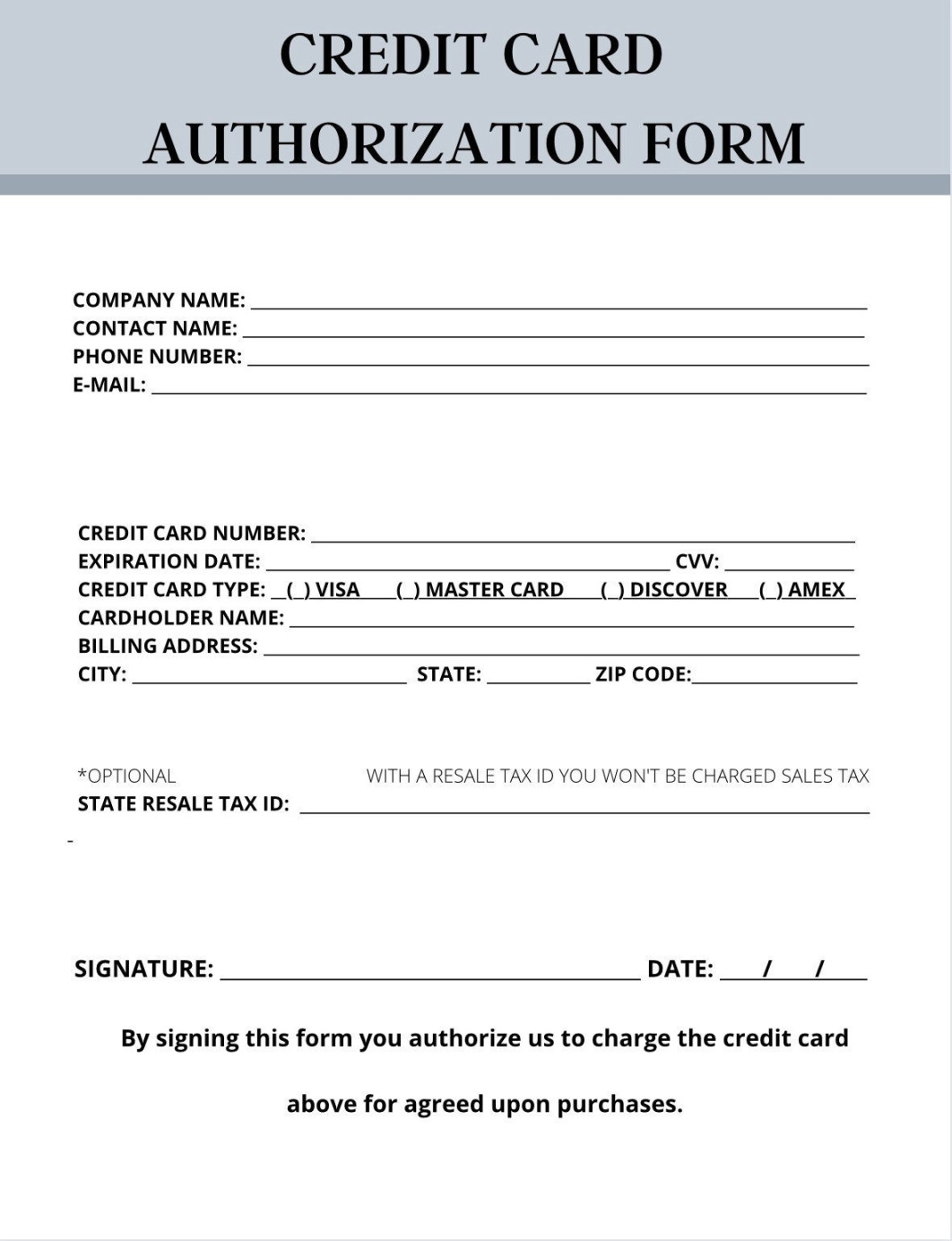

1. Merchant Information: Clearly display the merchant’s name, business address, ABN (Australian Business Number), and contact information. This information ensures transparency and accountability.

2. Customer Information: Collect the customer’s full name, billing address, email address, and phone number. This information is vital for verifying the transaction and providing customer support.

3. Credit Card Details: Request the customer’s credit card number, expiration date, and CVV (Card Verification Value). Ensure that the credit card details are entered securely, using appropriate encryption methods to protect sensitive data.

4. Transaction Amount: Specify the total amount of the transaction, including any applicable taxes or fees.

5. Authorization Signature: Provide a space for the customer to sign the form, indicating their authorization for the transaction.

6. Terms and Conditions: Clearly outline the terms and conditions of the transaction, including the merchant’s refund policy, dispute resolution process, and any additional fees or charges.

7. Privacy Policy: Refer to the merchant’s privacy policy, which should explain how customer data is collected, used, and protected.

8. Date and Time: Stamp the form with the date and time of the transaction to create a record of the purchase.

Design Considerations for a Professional Credit Card Authorization Form

1. Layout and Organization: Use a clean and uncluttered layout that is easy to read and navigate. Group related information together and use headings and subheadings to improve readability.

2. Font and Typography: Choose a professional and legible font that is easy on the eyes. Avoid using excessive fonts or font sizes that can make the form appear cluttered.

3. Color Scheme: Select a color scheme that is consistent with your brand and creates a professional and trustworthy impression. Use colors that are easy to read and contrast well with the background.

4. Branding: Incorporate your brand’s logo, colors, and messaging into the form design. This helps to build trust and recognition.

5. Clear and Concise Language: Use clear and concise language that is easy for customers to understand. Avoid legal jargon or technical terms that may confuse customers.

6. Security Indicators: Display security seals or certifications to reassure customers that their information is protected. This can include logos from organizations like PCI DSS (Payment Card Industry Data Security Standard).

Legal Compliance

Ensure that your credit card authorization form complies with Australian consumer laws and regulations, including the Australian Consumer Law (ACL). This involves:

Fair Trading: Ensure that the form does not contain any misleading or deceptive information.

By following these guidelines, you can create a professional and legally compliant credit card authorization form template that effectively protects your business and provides a positive customer experience.