A credit assignment agreement is a legal document that transfers the rights and obligations of a creditor to another party, known as the assignee. This agreement is crucial in various financial transactions, including debt collection, loan securitization, and asset-backed securities. When creating a credit assignment agreement template, it is essential to adhere to specific design elements that convey professionalism and trust.

Key Components of a Credit Assignment Agreement Template

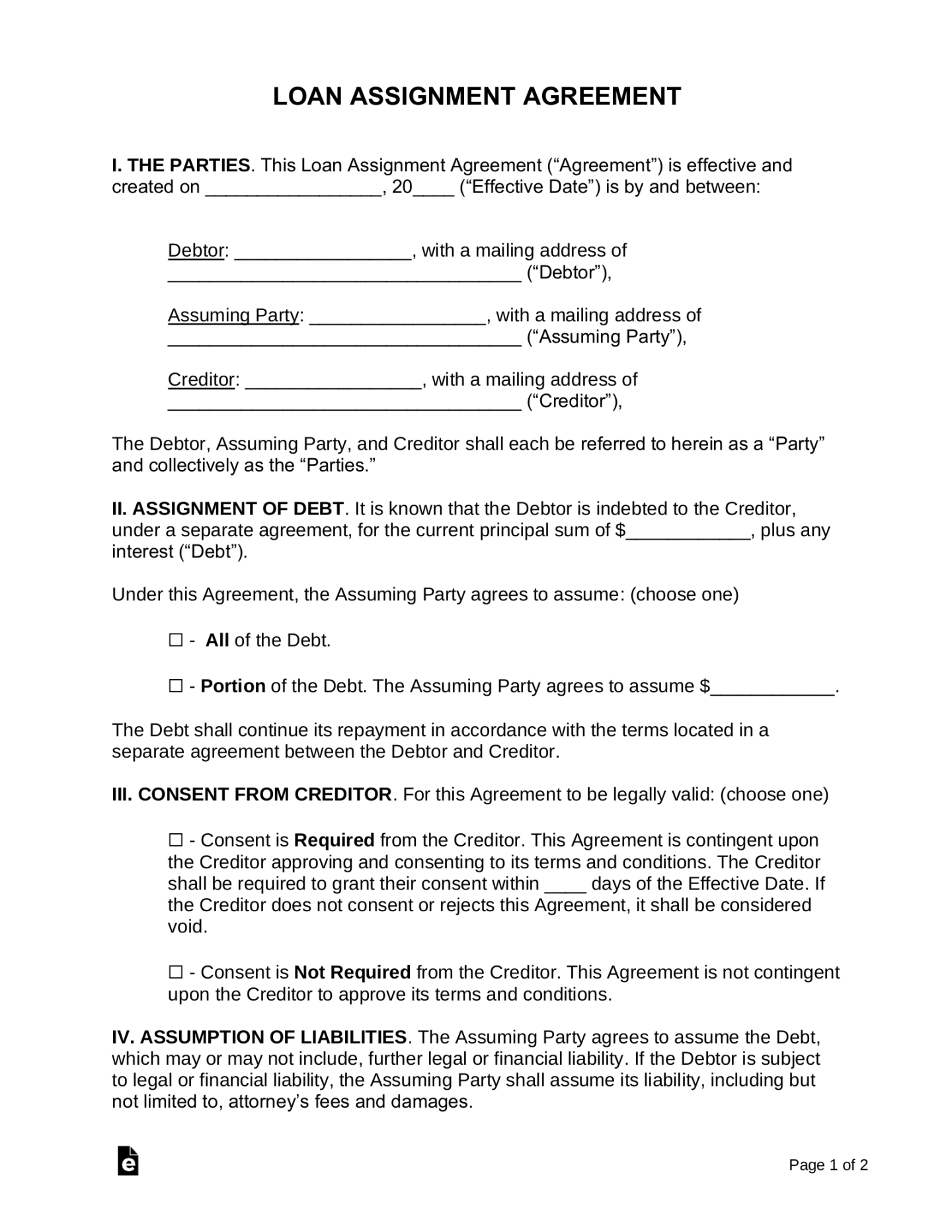

1. Identification of Parties: Clearly state the names and addresses of the assignor (original creditor) and the assignee (new creditor).

2. Description of the Assigned Credit: Provide a detailed description of the credit being transferred, including the principal amount, interest rate, maturity date, and any collateral.

3. Assignment of Rights and Obligations: Explicitly state that the assignor is transferring all rights, title, and interest in the credit to the assignee.

4. Assumption of Obligations: Indicate that the assignee is assuming all obligations related to the credit, including the right to collect payments and enforce any security interests.

5. Consideration: Specify the consideration (payment or other value) that the assignee is providing to the assignor in exchange for the credit assignment.

6. Warranties and Representations: Include warranties and representations from the assignor regarding the validity and enforceability of the credit, the absence of any defenses or offsets, and the accuracy of the information provided.

7. Default and Remedies: Outline the consequences of default by the debtor and the remedies available to the assignee, such as the right to accelerate the debt, foreclose on collateral, or file a lawsuit.

8. Notices: Specify how and when notices must be given between the assignor and the assignee.

9. Governing Law and Jurisdiction: Indicate the governing law that will apply to the agreement and the jurisdiction in which any disputes will be resolved.

10. Entire Agreement: State that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous agreements.

Design Elements for Professionalism and Trust

Clear and Concise Language: Use plain language that is easy to understand. Avoid legal jargon or technical terms that may confuse the parties.

By incorporating these design elements into your credit assignment agreement template, you can create a professional and trustworthy document that effectively transfers credit rights and obligations between the parties.