A Corporate Credit Card Agreement Template is a legally binding document that outlines the terms and conditions governing the use of a corporate credit card by an authorized employee or representative of a company. This template serves as a contract between the company and the credit card issuer, ensuring that both parties understand their rights and responsibilities.

Key Components of a Corporate Credit Card Agreement Template

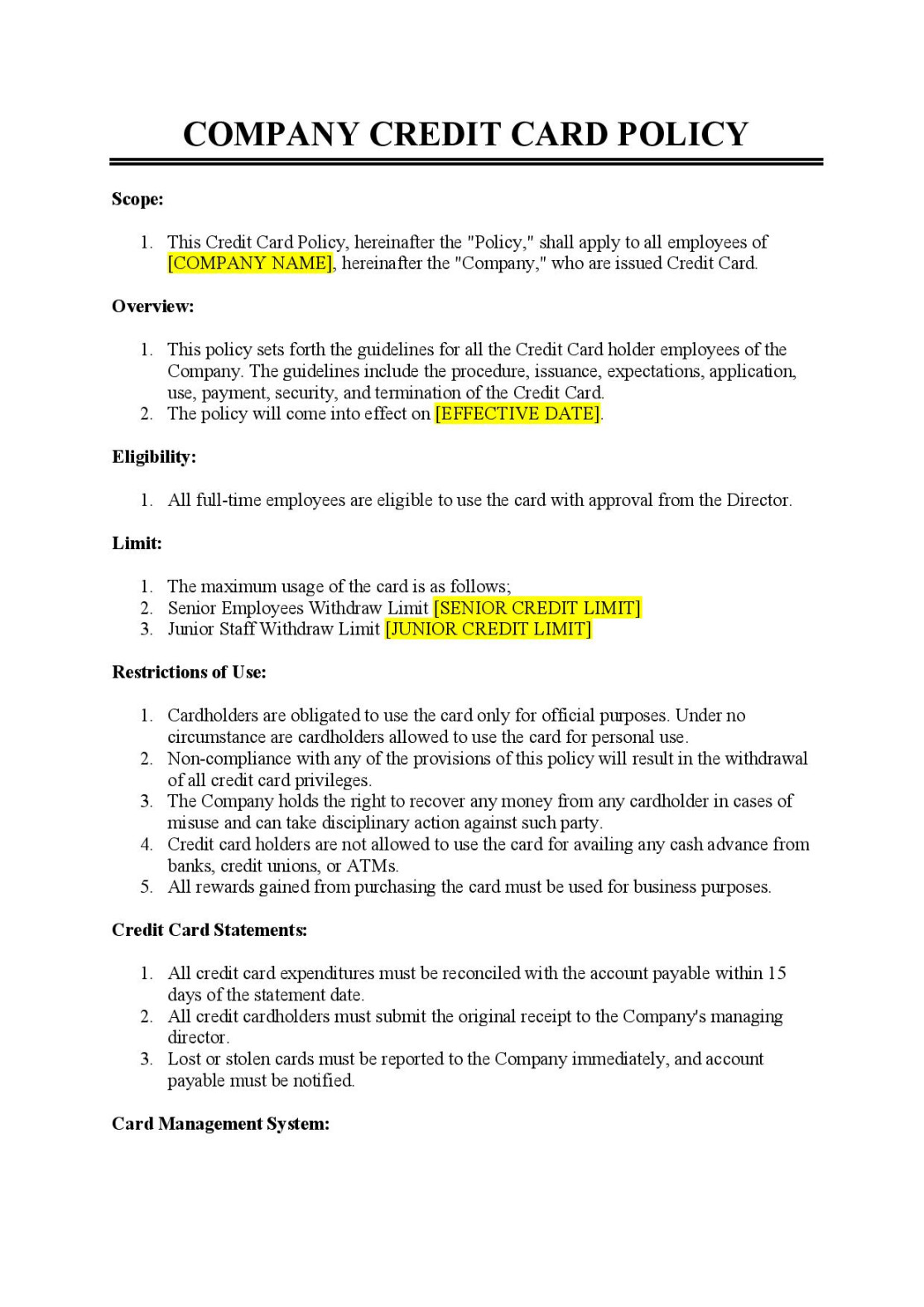

A well-structured Corporate Credit Card Agreement Template should include the following essential components:

1. Identification of Parties

Clearly state the names and addresses of both the company and the credit card issuer.

2. Card Information

Provide detailed information about the credit card, including the card number, expiration date, and any associated limits or restrictions.

3. Authorized Users

List the individuals who are authorized to use the corporate credit card.

4. Permissible Charges

Clearly define the types of charges that are allowed on the corporate credit card.

5. Payment Terms

Specify the due date for monthly payments.

6. Billing and Statements

Describe the billing cycle and how statements will be provided.

7. Liability and Dispute Resolution

Outline the company’s liability for unauthorized charges.

8. Termination and Default

Indicate the circumstances under which either party can terminate the agreement.

9. Governing Law and Jurisdiction

Specify the governing law that will apply to the agreement.

10. Entire Agreement

Designing a Professional Corporate Credit Card Agreement Template

To create a professional and effective Corporate Credit Card Agreement Template, consider the following design elements:

Clarity and Conciseness: Use clear and concise language to avoid confusion.

By carefully crafting a Corporate Credit Card Agreement Template, companies can establish clear guidelines for the use of corporate credit cards and protect themselves from potential liabilities.