A commercial mortgage broker fee agreement template is a crucial document that outlines the terms and conditions governing the relationship between a commercial mortgage broker and a borrower seeking financing. It serves as a legally binding contract that protects the interests of both parties involved. When creating such a template, it is essential to prioritize clarity, comprehensiveness, and professionalism.

Key Components of a Commercial Mortgage Broker Fee Agreement Template

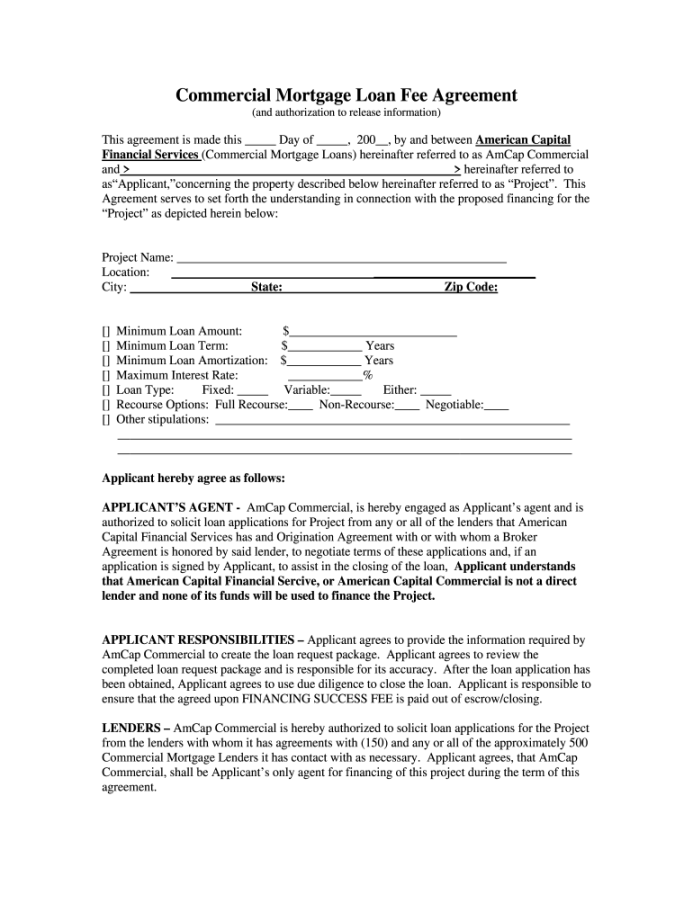

1. Parties Involved: Clearly identify the parties to the agreement, including the name, address, and contact information of the commercial mortgage broker and the borrower.

2. Scope of Services: Define the specific services that the broker will provide. This may include identifying potential lenders, negotiating terms, assisting with loan application, and providing guidance throughout the loan process.

3. Brokerage Fee: Specify the amount of the brokerage fee and how it will be calculated. This could be a flat fee, a percentage of the loan amount, or a combination of both.

4. Reimbursement of Expenses: Outline the expenses that the borrower will be responsible for reimbursing the broker, such as appraisal fees, credit Report fees, and other costs associated with the loan process.

5. Confidentiality: Include a confidentiality clause that protects the sensitive information shared between the broker and the borrower.

6. Term and Termination: Specify the duration of the agreement and the conditions under which either party can terminate it.

7. Governing Law: Indicate the jurisdiction that will govern the agreement in case of a dispute.

8. Notices: Establish how notices will be given to the parties, such as by email, certified mail, or courier.

9. Entire Agreement: Clearly state that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications or agreements.

10. Signatures: Ensure that both parties sign the agreement to make it legally binding.

Design Elements for a Professional Commercial Mortgage Broker Fee Agreement Template

When designing a commercial mortgage broker fee agreement template, consider the following elements to convey professionalism and trust:

Layout: Use a clean and uncluttered layout that is easy to read and navigate.

Additional Considerations

Customization: Tailor the template to the specific needs and circumstances of the borrower and the loan.

By carefully considering these key components and design elements, you can create a professional commercial mortgage broker fee agreement template that effectively protects the interests of both the broker and the borrower.