A commercial loan agreement template is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It is essential for both parties to have a clear understanding of their rights and obligations before entering into a loan agreement.

Key Elements of a Commercial Loan Agreement Template

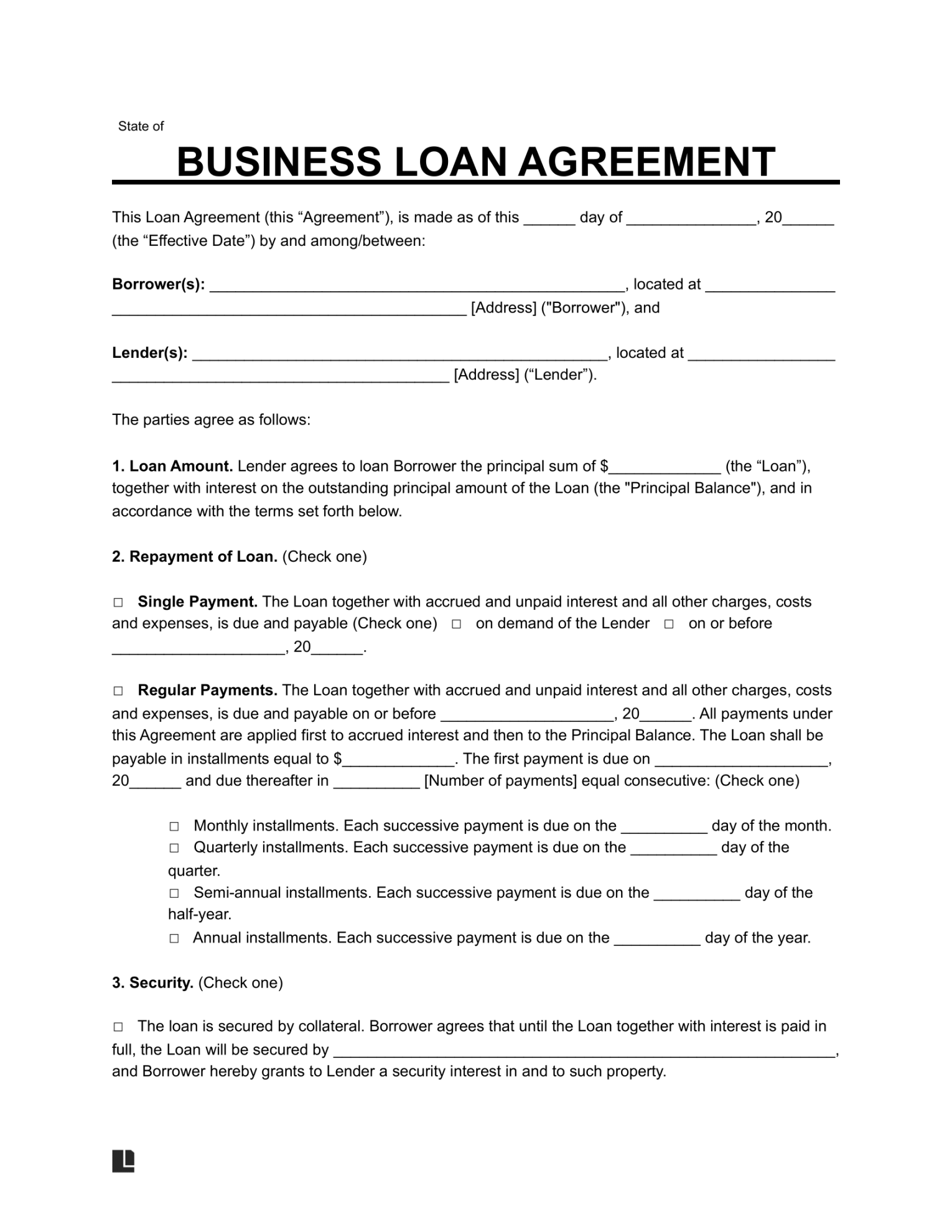

1. Parties: This section identifies the lender and borrower involved in the loan agreement. It should include their full legal names and addresses.

2. Loan Amount: The loan amount is the total sum of money being borrowed. It should be clearly stated in the agreement, along with any interest rates or fees associated with the loan.

3. Repayment Schedule: The repayment schedule outlines how the borrower will repay the loan. It should include the frequency of payments, the amount of each payment, and the due date for each payment.

4. Interest Rate: The interest rate is the cost of borrowing the money. It should be clearly stated in the agreement, along with the method used to calculate interest (e.g., simple interest, compound interest).

5. Security: If the lender requires collateral to secure the loan, the agreement should specify the type of collateral and the conditions under which the lender can seize the collateral.

6. Default: The default section outlines the consequences of the borrower failing to meet their obligations under the loan agreement. It should include provisions for late payments, missed payments, and other breaches of the agreement.

7. Governing Law: The governing law section specifies the jurisdiction that will govern the loan agreement. This is important in case of a dispute between the lender and the borrower.

8. Notices: The notices section outlines how the lender and the borrower will communicate with each other regarding the loan agreement. It should include information on the addresses to which notices should be sent and the method of delivery (e.g., email, mail).

9. Entire Agreement: The entire agreement clause states that the loan agreement constitutes the entire agreement between the lender and the borrower and that any prior or contemporaneous agreements are superseded.

Design Elements for a Professional Commercial Loan Agreement Template

1. Clear and Concise Language: The language used in the loan agreement should be clear and concise, avoiding legal jargon that may be difficult for the borrower to understand.

2. Consistent Formatting: The loan agreement should be formatted consistently throughout, using the same font, font size, and spacing.

3. Headings and Subheadings: Use headings and subheadings to break up the text and make it easier to read.

4. White Space: Use white space to create a visually appealing document and make the text easier to read.

5. Professional Layout: The overall layout of the loan agreement should be professional and well-organized.

6. Legal Disclaimer: A legal disclaimer can be included at the end of the loan agreement to inform the borrower that the agreement is a legally binding document.

7. Signature Lines: Provide signature lines for both the lender and the borrower to sign the agreement.

By following these guidelines, you can create a professional commercial loan agreement template that is easy to read, understand, and legally binding.