A charitable contribution receipt is a formal document issued by a non-profit organization to acknowledge a donation made by an individual or a business. This receipt serves as proof of the donation for tax purposes, allowing the donor to claim a deduction on their tax return.

Key Elements of a Charitable Contribution Receipt:

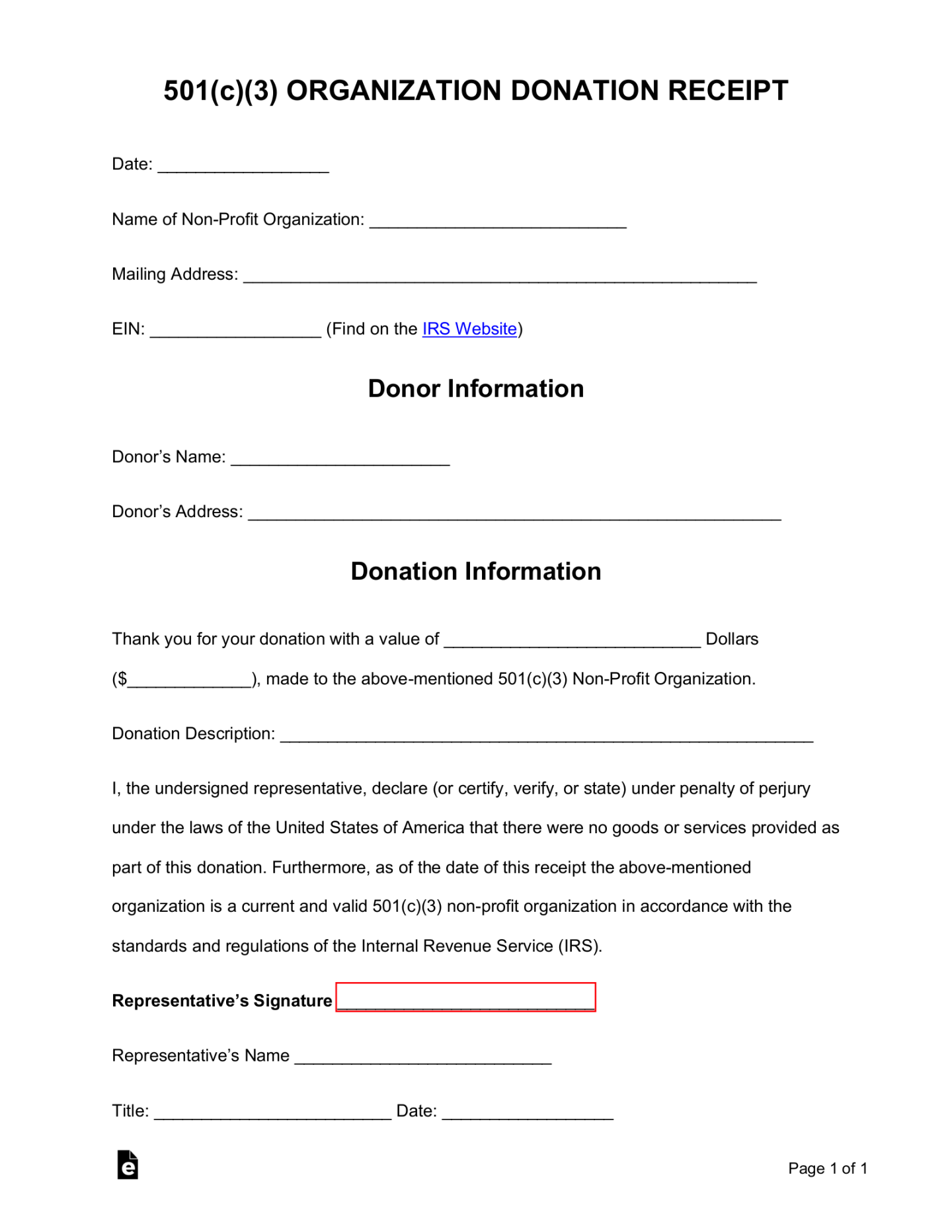

Donor Information: This section should include the donor’s full name, mailing address, and contact information.

Design Considerations:

Layout and Formatting: The receipt should have a clean and professional layout, with clear headings and subheadings. Use a legible font and consistent spacing throughout the document.

Donor Information

The donor’s information should be placed prominently at the top of the receipt. Include their full name, mailing address, and contact information. This information is essential for verifying the donation and for future correspondence.

Organization Information

The non-profit organization’s information should be clearly displayed, including the name, address, and tax identification number (EIN). The EIN is crucial for tax purposes and can be obtained from the Internal Revenue Service (IRS).

Donation Date

The exact date the donation was received should be stated. This information is important for tracking donations and for tax purposes.

Donation Amount

The total amount of the donation should be clearly indicated, including any cash, checks, or in-kind contributions. If the donation was in-kind, provide a detailed description of the goods or services.

Description of Goods or Services

If the donation was in the form of goods or services, a detailed description should be provided. This information is necessary for tax purposes and to ensure proper accounting.

Designation of Funds

If the donor specified that the donation should be used for a particular purpose, this should be noted. This information helps the non-profit organization allocate funds effectively.

Acknowledgment Statement

A statement acknowledging that the donation is a gift and not a payment for goods or services should be included. This is important for tax purposes and to avoid any misunderstandings.

Signature

The receipt should be signed by an authorized representative of the non-profit organization. This signature verifies the authenticity of the document.

By following these guidelines, you can create a professional and informative charitable contribution receipt template that meets the needs of both the donor and the non-profit organization.