A business loan agreement template is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This document is crucial for protecting the interests of both parties and ensuring that the loan is repaid in full, with interest. A well-crafted template should be clear, concise, and legally sound.

Essential Elements of a Business Loan Agreement Template

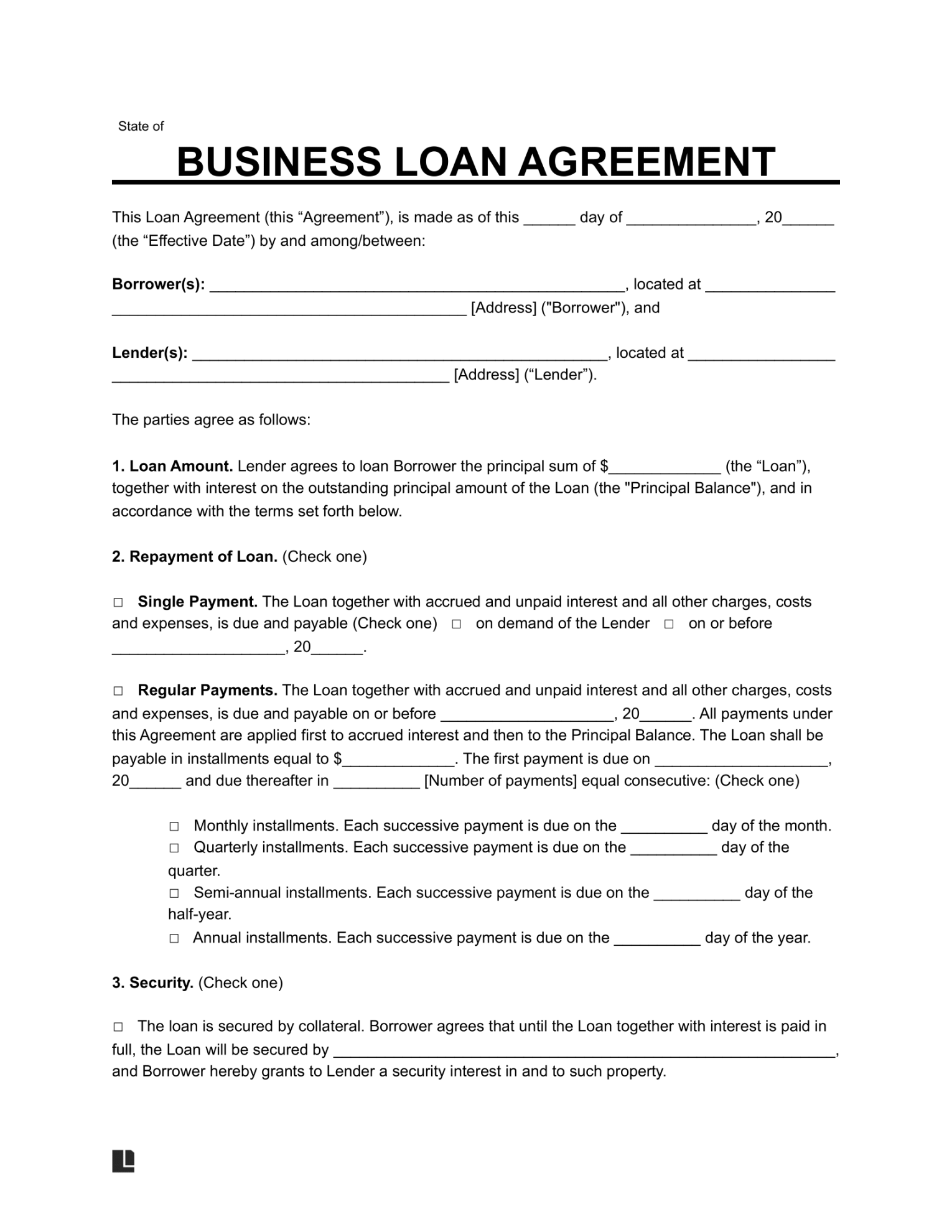

A business loan agreement template should include the following essential elements:

Parties Involved

Lender: The individual or entity providing the loan.

Loan Amount and Terms

Principal Amount: The total amount of the loan.

Security

Collateral: Any assets pledged as security for the loan.

Default and Remedies

Default: The failure to meet the terms of the loan.

Governing Law and Jurisdiction

Governing Law: The laws that apply to the agreement.

Design Elements for a Professional Business Loan Agreement Template

The design of a business loan agreement template is just as important as its content. A well-designed template can convey professionalism and trust, which is essential for building a strong relationship between the lender and the borrower.

Font and Font Size

Font: Choose a clear and legible font, such as Times New Roman or Arial.

Spacing and Margins

Spacing: Use consistent spacing between lines and paragraphs to improve readability.

Headers and Footers

Headers: Include the title of the document and the page number in the header.

Section Headings

Numbering and Bullet Points

Additional Tips for Creating a Professional Business Loan Agreement Template

Proofread Carefully: Ensure that the document is free of errors.

By following these guidelines, you can create a professional business loan agreement template that will protect the interests of both the lender and the borrower.