A promise to pay agreement is a legal document that outlines the terms and conditions under which a debtor agrees to repay a debt to a creditor. It is a crucial tool for both parties involved, as it provides a clear and concise record of the financial arrangement. This guide will delve into the key components of a professional promise to pay agreement template, ensuring that you create a document that is both legally sound and visually appealing.

Essential Elements of a Promise to Pay Agreement

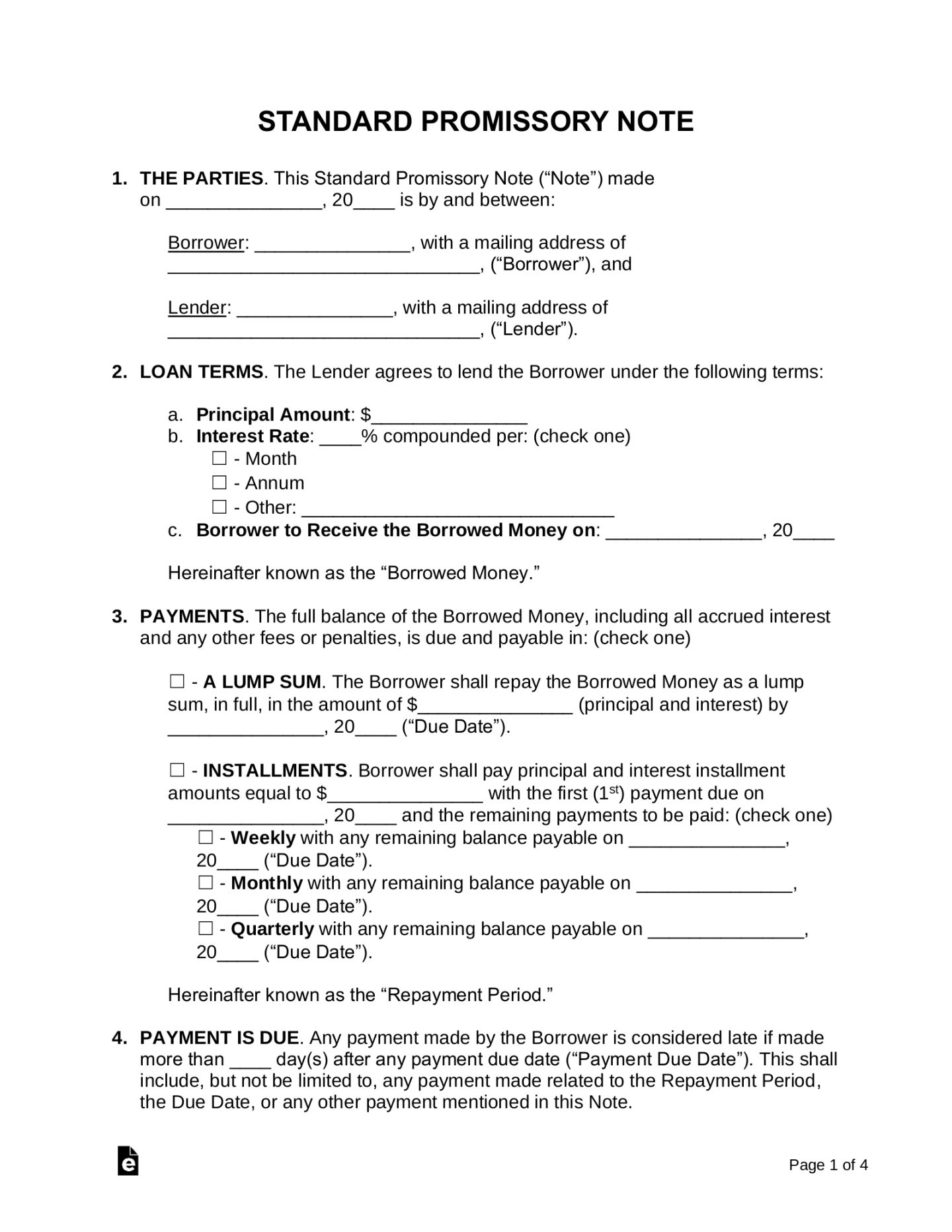

1. Identification of Parties: Clearly state the names and addresses of both the debtor and the creditor. This information should be presented in a formal and professional manner.

2. Debt Amount: Specify the exact amount of the debt, including any accrued interest or penalties. This information should be presented in a clear and concise format, using appropriate currency symbols.

3. Repayment Schedule: Outline the agreed-upon repayment schedule, including the frequency of payments, the amount of each payment, and the due date for each payment. This section should be organized in a table format for easy readability.

4. Interest Rate: If applicable, state the interest rate that will be applied to the outstanding debt. This information should be presented in a clear and concise manner, using the appropriate percentage symbol.

5. Late Payment Penalties: Specify any late payment penalties that will be imposed if the debtor fails to make timely payments. This information should be presented in a clear and concise manner, using appropriate language.

6. Default Provisions: Outline the consequences of default, including the potential acceleration of the debt, the imposition of additional fees, and the possibility of legal action. This section should be presented in a clear and concise manner, using appropriate language.

7. Governing Law: Specify the governing law that will apply to the promise to pay agreement. This information should be presented in a clear and concise manner, using appropriate language.

8. Dispute Resolution: Outline the dispute resolution process, including the procedures for mediation or arbitration. This section should be presented in a clear and concise manner, using appropriate language.

9. Notices: Specify the address to which notices should be sent. This information should be presented in a clear and concise manner, using appropriate language.

10. Signatures: Ensure that both the debtor and the creditor sign the agreement, indicating their acceptance of the terms and conditions. The signatures should be followed by the printed names of the signatories.

Design Considerations for a Professional Promise to Pay Agreement

To create a professional and visually appealing promise to pay agreement, consider the following design elements:

Font: Choose a font that is easy to read and professional in appearance. Avoid using fonts that are overly decorative or difficult to decipher.

By incorporating these design elements into your promise to pay agreement template, you can create a document that is both informative and visually appealing.