Purpose and Scope

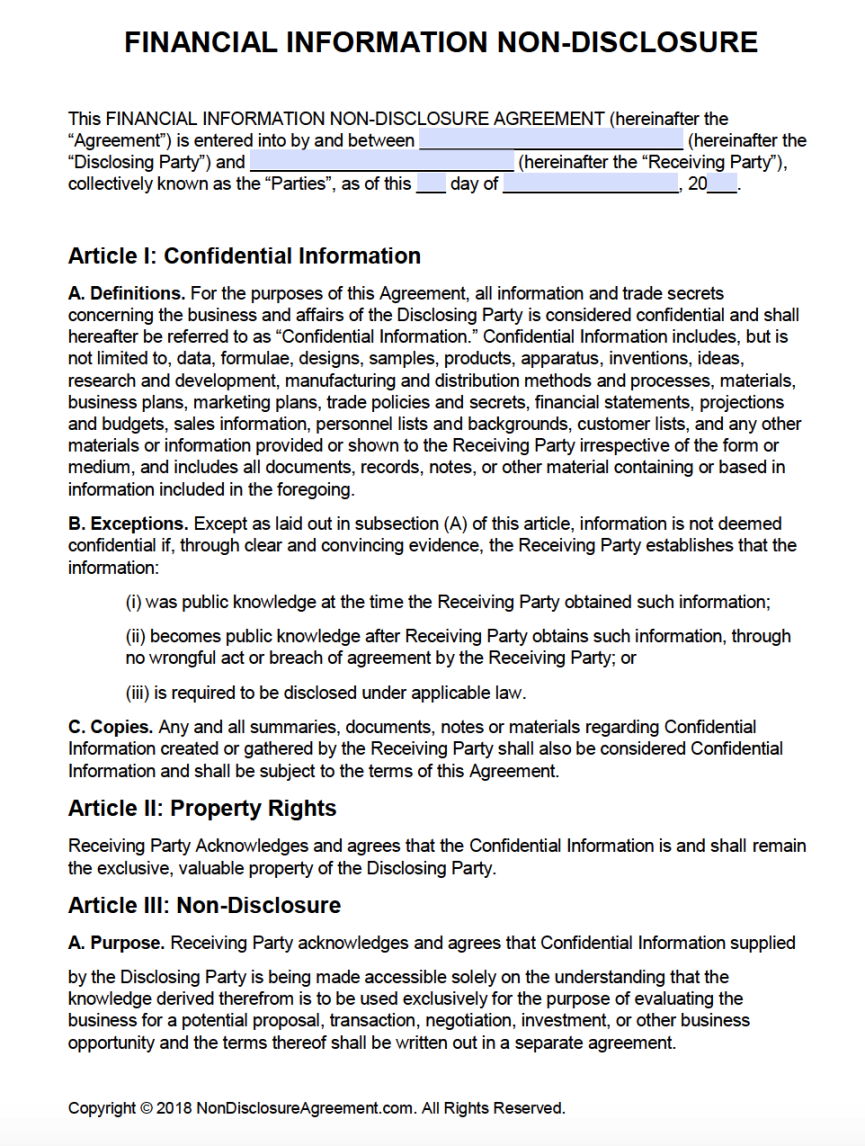

An accountant confidentiality agreement is a legally binding document that establishes a confidential relationship between an accountant and a client. This agreement outlines the specific information to be kept confidential, the duration of the confidentiality obligation, and the exceptions to confidentiality.

Key Components of an Accountant Confidentiality Agreement

1. Identification of Parties: Clearly state the names and addresses of the accountant and the client.

2. Definition of Confidential Information: Define what constitutes confidential information. This may include financial data, client records, tax returns, business plans, and any other information shared in the course of the accountant-client relationship.

3. Obligation of Confidentiality: Specify the accountant’s duty to maintain the confidentiality of all disclosed information. This obligation should extend to the accountant’s employees, agents, and subcontractors.

4. Exceptions to Confidentiality: Outline any circumstances under which the accountant may be permitted to disclose confidential information, such as when required by law, court order, or to prevent fraud or harm.

5. Duration of Confidentiality: Indicate the length of time the confidentiality obligation will remain in effect. This may be a specific period or an indefinite duration.

6. Return of Confidential Information: Specify the procedures for the return or destruction of confidential information upon termination of the accountant-client relationship.

7. Governing Law and Jurisdiction: Specify the governing law and jurisdiction that will apply to any disputes arising from the agreement.

8. Entire Agreement: State that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

9. Severability: Include a severability clause that states that if any provision of the agreement is found to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

10. Signatures: Ensure that both the accountant and the client sign the agreement to make it legally binding.

Design Considerations for a Professional Accountant Confidentiality Agreement

To convey professionalism and trust, consider the following design elements:

Clear and Concise Language: Use plain language that is easy to understand. Avoid legal jargon that may confuse clients.

Additional Considerations

Consult with an Attorney: While you can use a template as a starting point, it is recommended to consult with an attorney to ensure that the agreement is legally sound and tailored to your specific needs.

By following these guidelines and incorporating professional design elements, you can create a comprehensive and effective accountant confidentiality agreement that protects your clients’ sensitive information and strengthens your professional relationship.