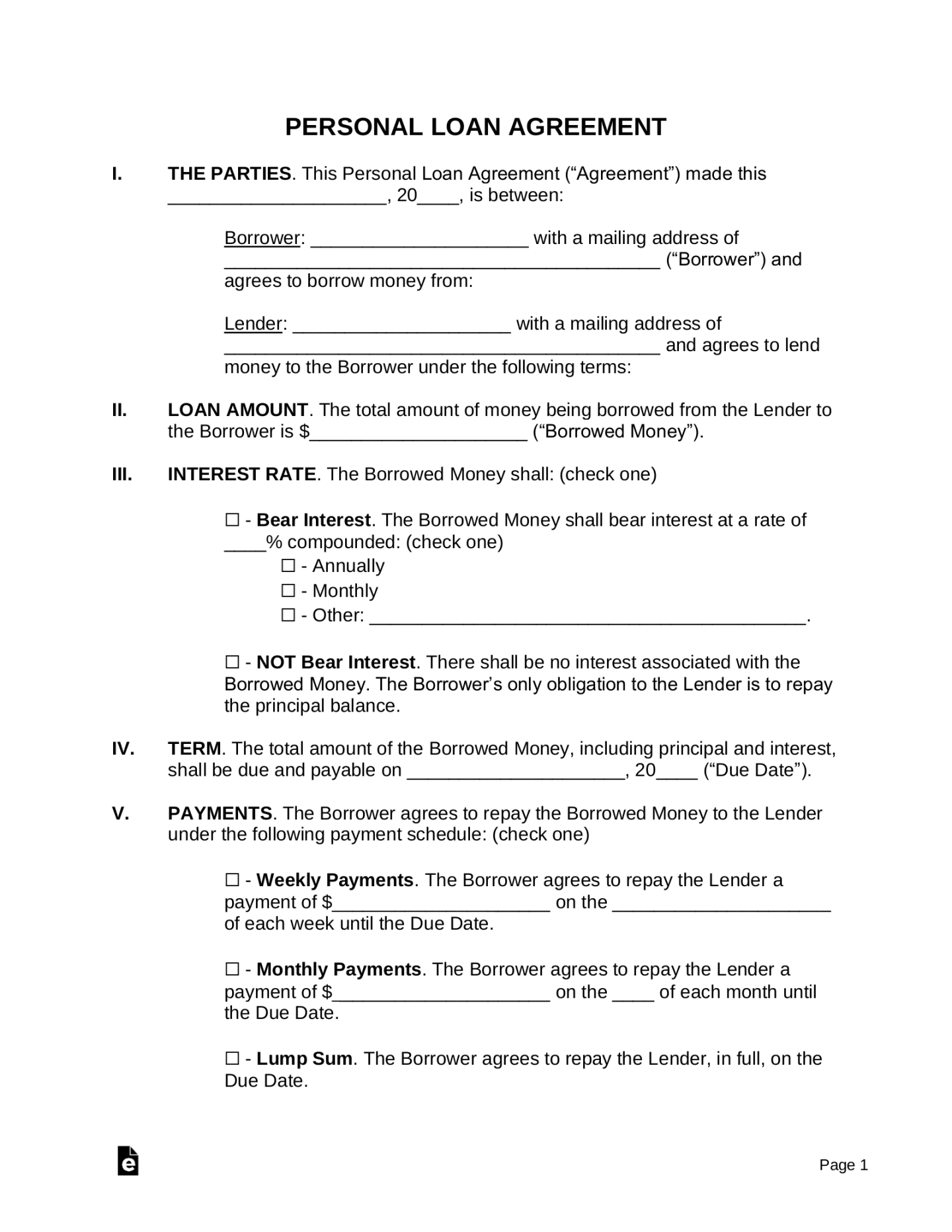

A personal loan repayment agreement template is a formal document that outlines the terms and conditions of a personal loan between a lender and a borrower. It serves as a legally binding contract that protects the interests of both parties involved. When creating a personal loan repayment agreement template, it is essential to adhere to specific design elements that convey professionalism and trust.

Essential Elements of a Personal Loan Repayment Agreement Template

1. Loan Amount and Terms: Clearly specify the total loan amount, interest rate, repayment schedule (e.g., monthly, bi-weekly), and the total amount due at the end of the loan term.

2. Repayment Schedule: Outline the specific dates and amounts of each installment payment. Consider using a table format for clarity and organization.

3. Late Payment Penalties: Clearly state the consequences of late or missed payments, such as late fees or interest accrual.

4. Prepayment Penalties: If applicable, outline any penalties for early repayment of the loan.

5. Default Provisions: Specify the actions that will be taken in the event of default, including legal recourse and potential collateral seizure.

6. Governing Law: Indicate the jurisdiction that will govern the agreement in case of disputes.

7. Entire Agreement Clause: State that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

8. Severability Clause: Specify that if any provision of the agreement is found to be invalid, the remaining provisions will remain in full force and effect.

9. Dispute Resolution: Outline the preferred method for resolving disputes, such as mediation or arbitration.

10. Signatures: Include a section for both the lender and borrower to sign the agreement, along with their printed names and dates.

Design Elements for Professionalism and Trust

1. Font Choice: Select a professional and legible font, such as Arial, Times New Roman, or Calibri. Avoid using overly decorative or difficult-to-read fonts.

2. Layout: Use a clean and organized layout with consistent margins, spacing, and headings. Consider using a table of contents to navigate the agreement easily.

3. Headings and Subheadings: Use clear and concise headings and subheadings to structure the agreement and improve readability.

4. Formatting: Use bullet points or numbered lists to present information in a clear and concise manner.

5. Language: Use formal and unambiguous language that is easy to understand. Avoid using jargon or technical terms that may confuse the parties.

6. Formatting: Use bold or italics to emphasize important terms or provisions.

7. White Space: Ensure there is adequate white space between paragraphs and sections to improve readability and visual appeal.

8. Branding: If applicable, incorporate your company’s branding elements, such as logo and color scheme, into the template design.

Additional Considerations

Customization: Tailor the template to the specific needs of your personal loan. Consider including additional clauses or provisions as necessary.

By following these guidelines and incorporating the essential elements of a personal loan repayment agreement template, you can create a professional and legally sound document that protects the interests of both the lender and the borrower.