Direct debit agreements are essential legal documents that outline the terms and conditions for recurring payments from a customer’s bank account. A well-crafted template can streamline the payment process, reduce administrative burdens, and foster trust between businesses and customers. This guide will delve into the key components and design considerations for creating a professional direct debit agreement template that effectively protects your business while providing a positive customer experience.

Essential Components

1. Agreement Parties: Clearly identify the parties involved in the agreement. This typically includes the business name and contact information, as well as the customer’s name and address.

2. Payment Information: Specify the payment frequency, amount, and the date on which payments will be initiated. Include details about any variable charges or fees that may apply.

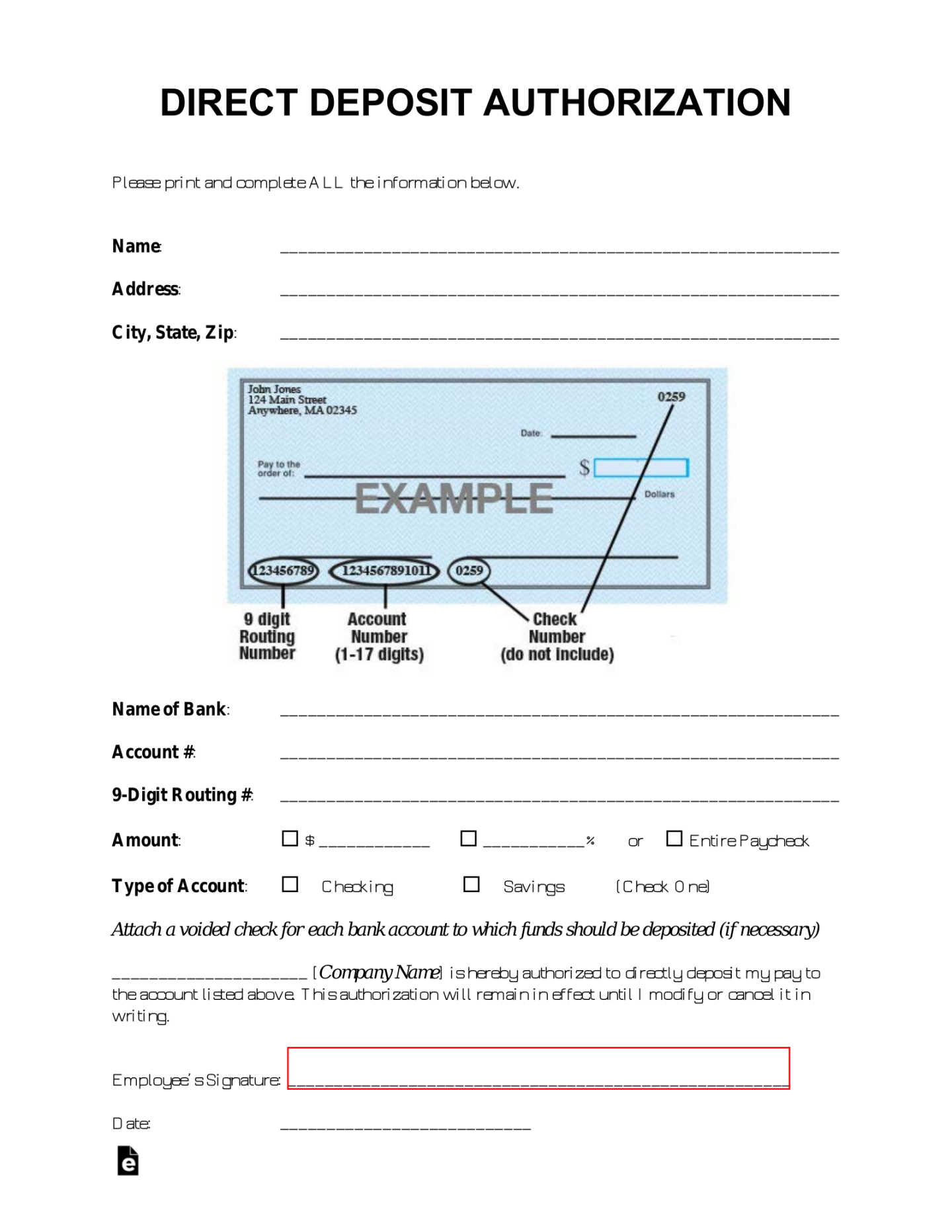

3. Mandate: Obtain a clear mandate from the customer authorizing the business to initiate direct debit payments from their bank account. This mandate should include the customer’s bank account details and a signature.

4. Direct Debit Guarantee: Inform customers about their rights under the Direct Debit Guarantee, which provides them with protection in case of unauthorized payments or errors.

5. Cancellation Policy: Outline the procedures for canceling the direct debit agreement. Specify the notice period required and any applicable fees.

6. Dispute Resolution: Establish a process for resolving disputes that may arise regarding the direct debit agreement. This may include mediation or arbitration.

7. Governing Law: Indicate the jurisdiction that governs the agreement. This helps to clarify any legal disputes that may occur.

Design Considerations

1. Clarity and Conciseness: Use clear and concise language that is easy for customers to understand. Avoid legal jargon that may confuse or alienate them.

2. Professional Layout: Choose a professional and visually appealing layout that reflects the credibility of your business. Use consistent fonts, spacing, and headings to enhance readability.

3. Branding Elements: Incorporate your brand’s logo, colors, and fonts to create a cohesive and recognizable template. This helps to build trust and reinforce your brand identity.

4. Customer-Centric Language: Use language that emphasizes the benefits of direct debit payments for customers, such as convenience and security.

5. Legal Compliance: Ensure that your template complies with all relevant laws and regulations regarding direct debit payments. This may vary depending on your location.

Sample Template Structure

Heading: Direct Debit Agreement

Agreement Parties

Business Name

Payment Information

Payment Frequency

Mandate

Customer’s Bank Details

Direct Debit Guarantee

Cancellation Policy

Notice Period

Dispute Resolution

Governing Law

By signing this agreement, the customer authorizes the business to initiate direct debit payments from their bank account.

Customer Signature:

Date:

Business Signature:

Date:

By carefully considering these components and design elements, you can create a professional direct debit agreement template that effectively protects your business while providing a positive experience for your customers.