Essential Sections

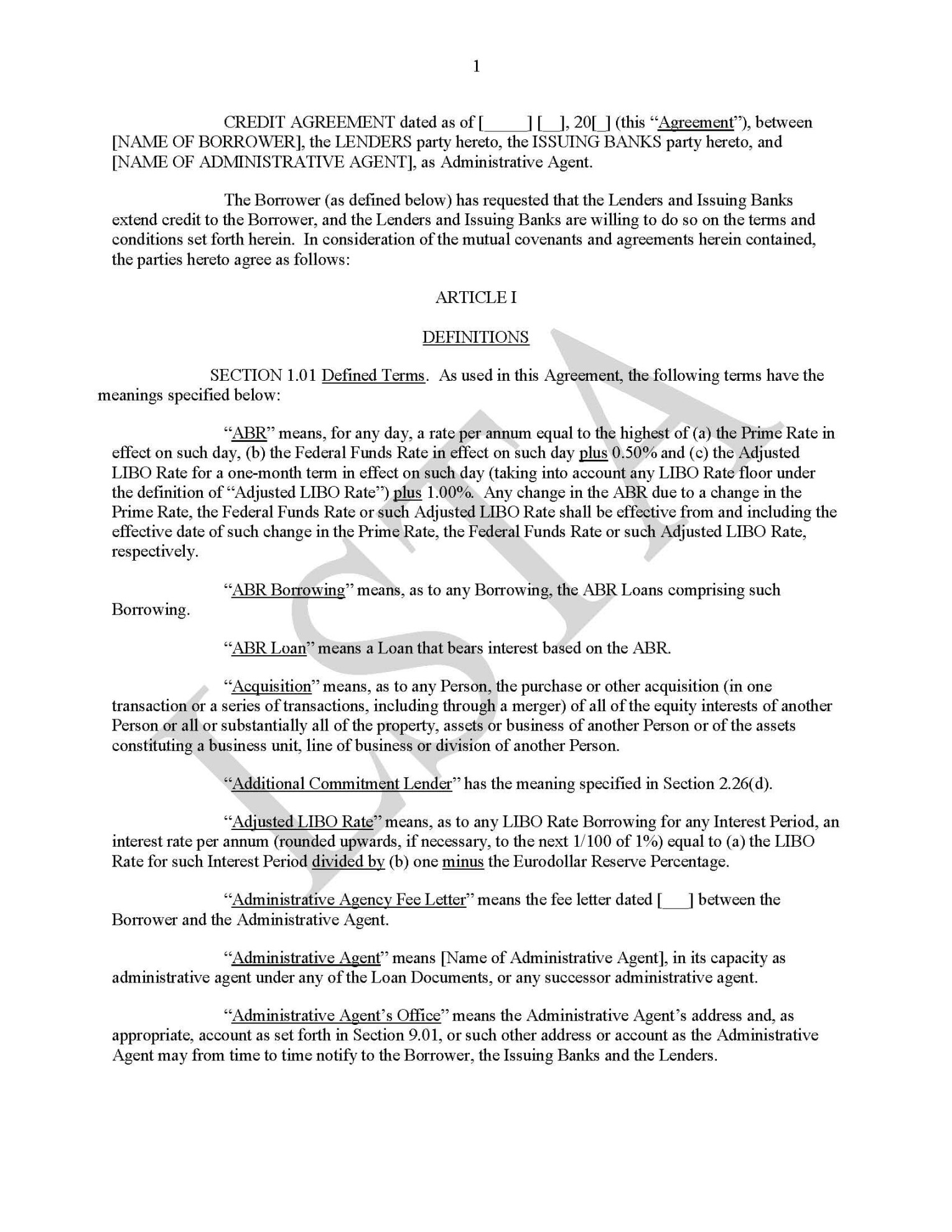

A revolving credit facility agreement template serves as a foundational document for establishing a financial relationship between a lender and a borrower, where the borrower can access funds up to a predetermined limit. This agreement outlines the terms and conditions governing the loan, ensuring transparency and mutual understanding between the parties involved.

1. Borrower and Lender Identification

Clearly state the names and legal entities of both the borrower and the lender.

2. Credit Limit

Specify the maximum amount of credit that the borrower can access under the agreement.

3. Interest Rate

Clearly define the interest rate that will be applied to the outstanding balance of the loan.

4. Repayment Terms

Outline the repayment schedule, including the frequency of payments (e.g., monthly, quarterly) and the minimum amount due.

5. Security

If applicable, describe the collateral or security that the borrower is providing to secure the loan.

6. Covenants

Outline the covenants or restrictions that the borrower must adhere to during the term of the loan.

7. Events of Default

Define the events that could trigger a default under the agreement.

8. Remedies in Case of Default

Specify the remedies available to the lender in the event of a default.

9. Term and Termination

Specify the term of the agreement, including the start and end dates.

10. Governing Law and Jurisdiction

Indicate the governing law that will apply to the agreement.

11. Notices

Establish the procedures for giving notices between the borrower and the lender.

12. Entire Agreement

13. Amendment and Waiver

14. Counterparts

15. Severability

16. Assignment

17. Force Majeure

18. Indemnification

19. Dispute Resolution

20. Execution

Provide space for the signatures of authorized representatives of both the borrower and the lender.

Design Elements for Professionalism and Trust

To enhance the professionalism and trustworthiness of the revolving credit facility agreement template, consider the following design elements:

Clear and Concise Language: Use plain and simple language that is easy to understand. Avoid legal jargon or technical terms that may confuse the parties.

By carefully crafting and designing the revolving credit facility agreement template, you can create a document that effectively establishes the financial relationship between the borrower and the lender, while also conveying professionalism and trust.