A non-recourse loan agreement is a legal document that outlines the terms and conditions of a loan where the lender is only entitled to recover the loan amount from the specific collateral pledged as security. This type of loan is often used in real estate transactions, where the property itself serves as the primary collateral.

Key Elements of a Non-Recourse Loan Agreement

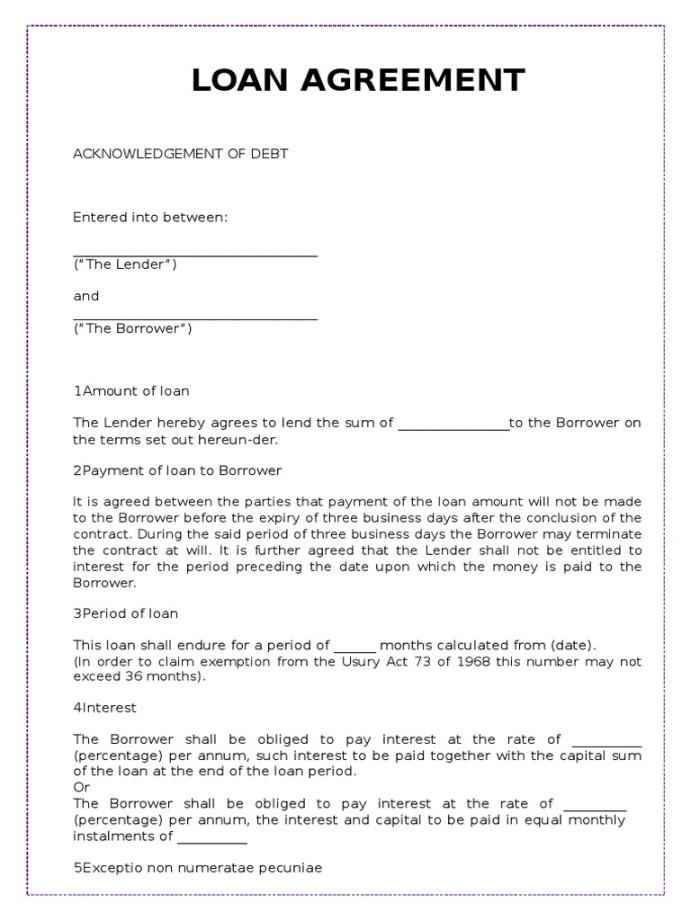

1. Parties: Clearly identify the borrower and the lender. Include their full legal names, addresses, and contact information.

2. Loan Amount: Specify the exact amount of the loan being granted.

3. Interest Rate: Indicate the interest rate that will be charged on the loan, whether it’s a fixed or variable rate.

4. Repayment Schedule: Outline the repayment terms, including the frequency of payments (e.g., monthly, quarterly) and the due dates.

5. Collateral: Describe the specific collateral being pledged as security for the loan. This may include real estate property, equipment, or other assets.

6. Default: Define what constitutes a default on the loan, such as missed payments or failure to meet other obligations.

7. Remedies: Specify the remedies available to the lender in case of default, including foreclosure on the collateral or other legal actions.

8. Non-Recourse Clause: Clearly state the non-recourse nature of the loan, indicating that the lender’s right to collect is limited to the collateral.

9. Governing Law: Specify the jurisdiction that will govern the agreement in case of disputes.

10. Entire Agreement: Include a clause stating that the agreement constitutes the entire understanding between the parties and supersedes any prior agreements or representations.

Design Elements for a Professional Non-Recourse Loan Agreement

1. Clear and Concise Language: Use plain language that is easy to understand, avoiding legal jargon whenever possible.

2. Consistent Formatting: Maintain consistent formatting throughout the document, using headings, subheadings, and bullet points to improve readability.

3. Professional Layout: Choose a professional font and font size that is easy to read. Use appropriate margins and spacing to create a clean and organized appearance.

4. Legal Headers and Footers: Include legal headers and footers containing the document title, date, and page numbers.

5. Signatures: Provide a designated space for both the borrower and the lender to sign the agreement. Include a place for witnesses to sign as well.

6. Legal Counsel: If necessary, include a statement acknowledging that both parties have consulted with legal counsel before entering into the agreement.

Additional Considerations

Customization: Tailor the agreement to the specific circumstances of the loan, addressing any unique terms or conditions.

By carefully considering these elements and following best practices, you can create a professional non-recourse loan agreement template that effectively protects the interests of both the lender and the borrower.