A Blank Loan Agreement Template is a foundational document that outlines the terms and conditions of a loan between a lender and a borrower. It serves as a legal contract that protects the interests of both parties involved. When creating a Blank Loan Agreement Template, it is essential to adhere to a formal, professional tone that conveys trust and credibility. This guide will provide you with valuable insights into designing a template that meets these standards.

Key Elements of a Blank Loan Agreement Template

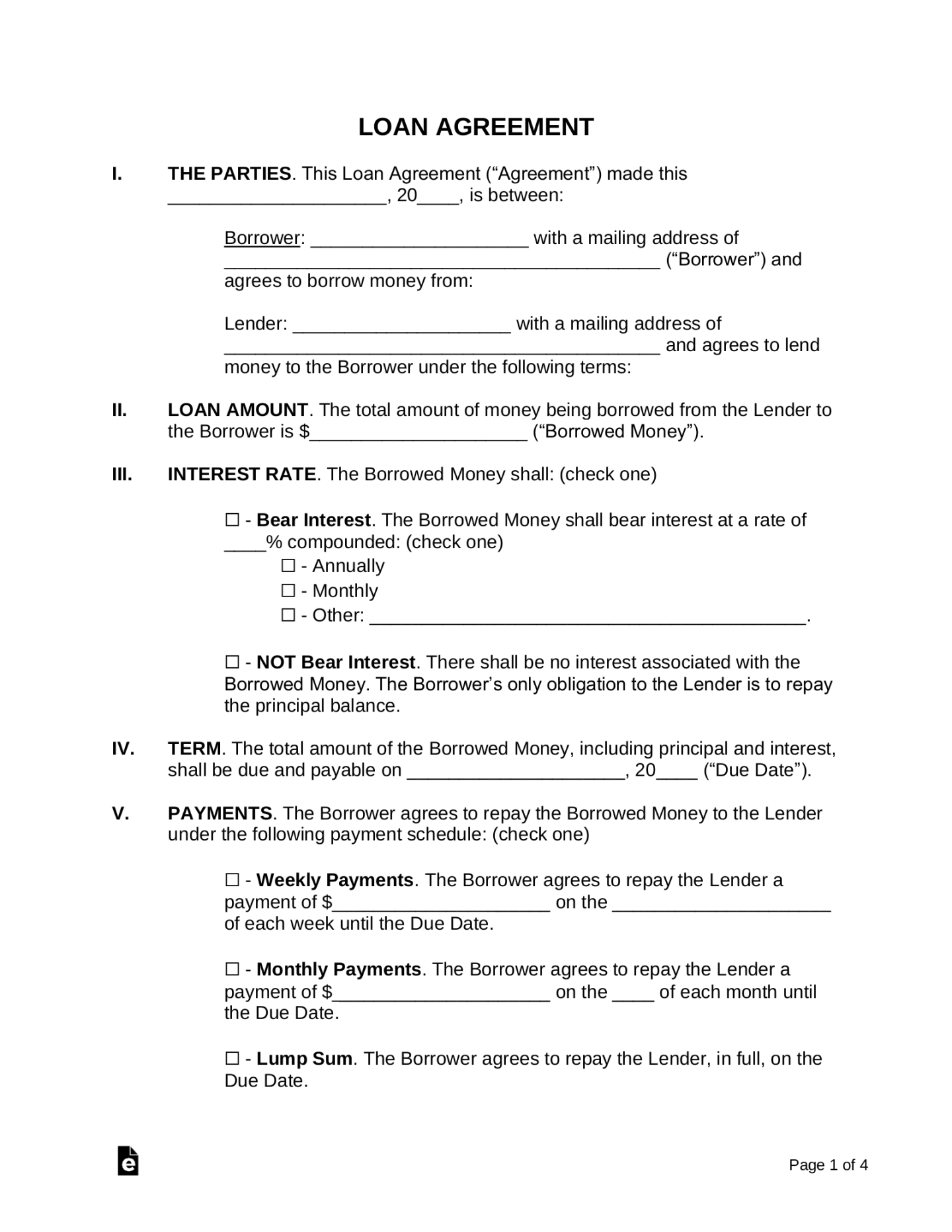

1. Loan Amount and Repayment Schedule: Clearly specify the total loan amount, interest rate, and repayment schedule, including due dates and payment frequency.

2. Collateral: If applicable, outline the specific collateral that will secure the loan. This could include property, equipment, or other valuable assets.

3. Default and Late Payment Provisions: Define the consequences of default or late payments, such as penalties, acceleration of the loan balance, or legal action.

4. Prepayment Clause: Specify whether the borrower can prepay the loan and, if so, under what conditions (e.g., prepayment penalty).

5. Governing Law and Jurisdiction: Indicate the governing law and jurisdiction that will apply to the loan agreement.

6. Entire Agreement Clause: State that the loan agreement constitutes the entire understanding between the parties, superseding any prior agreements or representations.

7. Severability Clause: Specify that if any provision of the loan agreement is found to be invalid or unenforceable, the remaining provisions will remain in full force and effect.

8. Notices: Outline the procedures for giving notices related to the loan agreement, such as changes in address or contact information.

9. Dispute Resolution: Specify the method for resolving disputes, such as mediation or arbitration.

10. Signatures: Ensure that both the lender and borrower sign the loan agreement to make it legally binding.

Design Considerations for a Professional Template

1. Layout and Formatting: Use a clean and consistent layout with ample white space to enhance readability. Choose a professional font that is easy to read, such as Times New Roman or Arial.

2. Headings and Subheadings: Use clear and concise headings and subheadings to organize the content and make it easy to navigate.

3. Language and Tone: Maintain a formal and professional tone throughout the document. Avoid using jargon or overly complex language.

4. Clarity and Conciseness: Express the terms and conditions in a clear and concise manner, avoiding ambiguity or contradictions.

5. Legal Terminology: Use accurate legal terminology when necessary, but provide definitions or explanations if needed to ensure understanding.

6. Organization and Structure: Arrange the sections of the loan agreement in a logical order, starting with the most fundamental terms and conditions.

7. Consistency: Ensure consistency in formatting, language, and terminology throughout the document.

Additional Tips for Creating a Professional Template

Consult with an Attorney: If you are unsure about the legal implications of certain terms or conditions, it is advisable to consult with an attorney who specializes in loan agreements.

By following these guidelines and incorporating the key elements of a professional Blank Loan Agreement Template, you can create a document that effectively protects the interests of both the lender and the borrower. A well-crafted template can foster trust, transparency, and a positive lending experience.