A credit analysis Report template is a structured document used to assess the creditworthiness of an individual or business. It provides a standardized framework for evaluating financial information, identifying potential risks, and making informed lending decisions. A well-designed template can enhance the efficiency and accuracy of credit analysis processes, while also conveying professionalism and trust to clients.

Key Components of a Credit Analysis Report Template

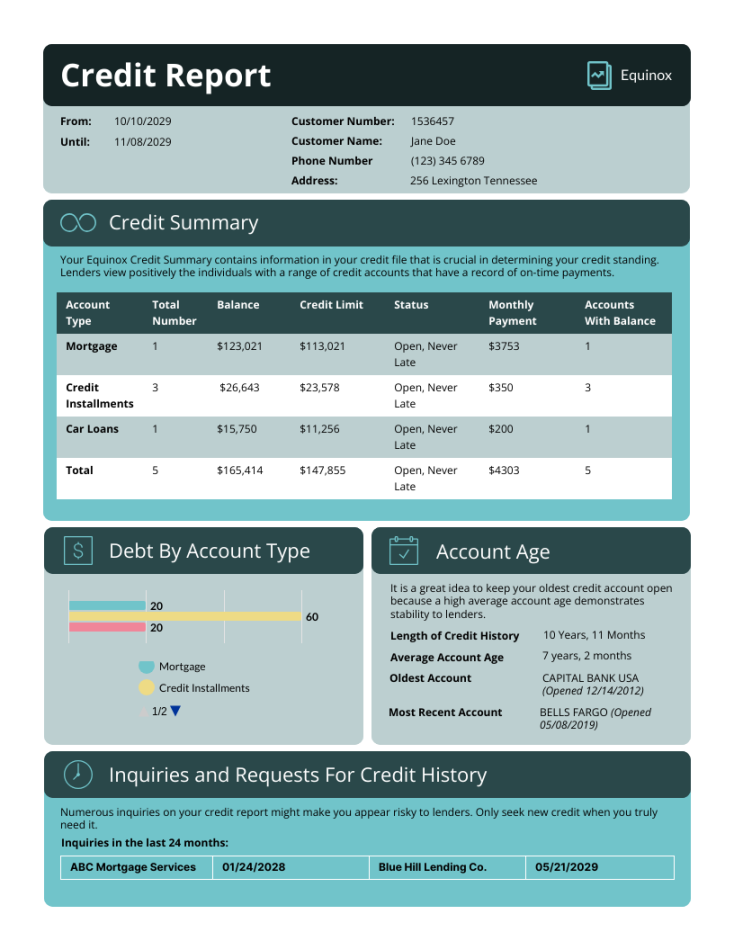

1. Executive Summary: This section should provide a concise overview of the report’s findings, including the applicant’s creditworthiness, key risk factors, and recommended course of action.

2. Applicant Information: This section should include the applicant’s name, contact information, and relevant demographic details.

3. Credit History: This section should summarize the applicant’s credit history, including past loans, credit Card accounts, and any derogatory information such as late payments or defaults.

4. Income and Expenses: This section should detail the applicant’s income sources and expenses, providing a clear picture of their financial situation.

5. Debt-to-Income Ratio: This section should calculate the applicant’s debt-to-income ratio, which is a key indicator of their ability to manage debt.

6. Collateral: If applicable, this section should describe any collateral that the applicant is offering to secure the loan.

7. Credit Score: This section should include the applicant’s credit score, which is a numerical representation of their creditworthiness.

8. Risk Assessment: This section should identify and assess potential risks associated with the loan, such as the applicant’s credit history, income stability, and economic conditions.

9. Recommendation: This section should provide a clear recommendation regarding whether the loan should be approved or denied, along with any conditions or requirements that may be necessary.

Design Elements for Professionalism and Trust

1. Consistent Formatting: Use a consistent font, font size, and spacing throughout the template to create a professional and polished look.

2. Clear and Concise Language: Avoid jargon and technical terms that may be unfamiliar to the reader. Use clear and concise language to convey information effectively.

3. Logical Structure: Organize the information in a logical and easy-to-follow manner, using headings and subheadings to guide the reader.

4. Professional Layout: Use a clean and uncluttered layout that is easy to read and navigate. Avoid excessive use of graphics or images that may distract from the content.

5. Branding Elements: Incorporate your company’s branding elements, such as your logo and color scheme, to create a sense of professionalism and trust.

6. Data Visualization: Use charts and graphs to visualize complex data and make it easier to understand.

7. Proofreading and Editing: Carefully proofread and edit the template to ensure that there are no errors in grammar, spelling, or punctuation.

Additional Considerations

Customization: Consider customizing the template to meet the specific needs of your organization and industry.

By following these guidelines and incorporating the recommended design elements, you can create a professional and effective credit analysis report template that will help you make informed lending decisions and build trust with your clients.